Question: please answer both Strawberry Fields purchased a tractor at a cost of $39,000 and sold it two years later for $25,800. Strawberry Fields recorded depreciation

please answer both

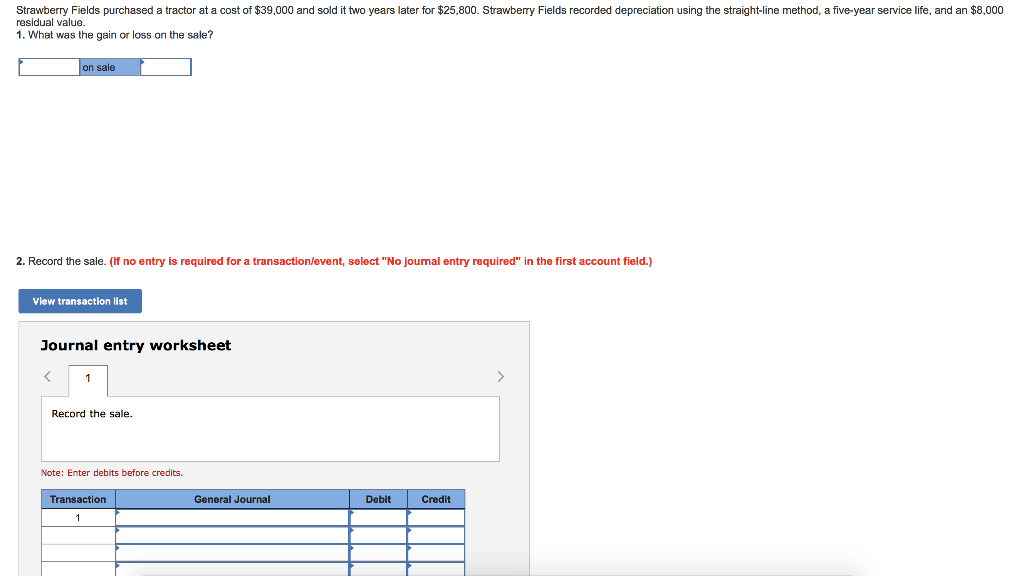

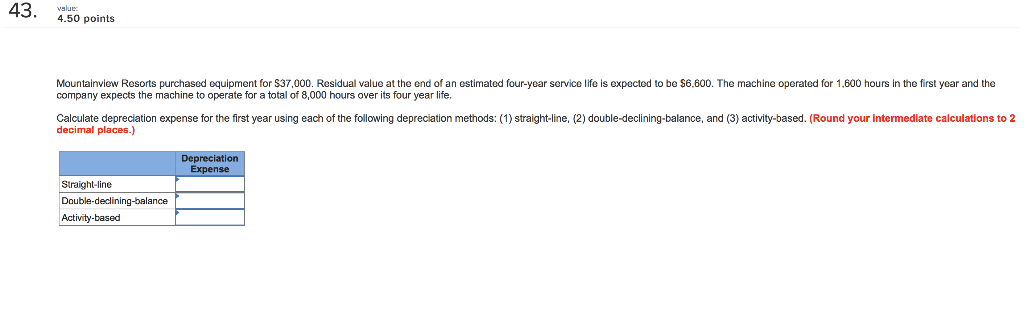

Strawberry Fields purchased a tractor at a cost of $39,000 and sold it two years later for $25,800. Strawberry Fields recorded depreciation using the straight-line method, a five-year service life, and an $8,000 residual value. 1. What was the gain or loss on the sale? sale 2. Record the sale. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the sale Note: Enter debits before credits. DebitCredit Transaction General Journal 43. 450 points Mountainview Resorts purchased equipment for S37,000. Residual value at the end of an estimated four-year service life is expected to be $6,600. The machine operated for 1.600 hours in the first year and the company expects the machine to operate for a total of 8,000 hours over its four year life. Calculate depreciation expense for the first year using each of the following depreciation methods: (1) straight-line, (2) double-declining-balance, and (3) activity-based. (Round your intermediate calculations to 2 decimal places.) Depreciation Straight-line Double-declining-balance Activity-based

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts