Question: please answer both thanks! Your firm is US based with the majority of its business being conducted in US$. However, you expect to pay a

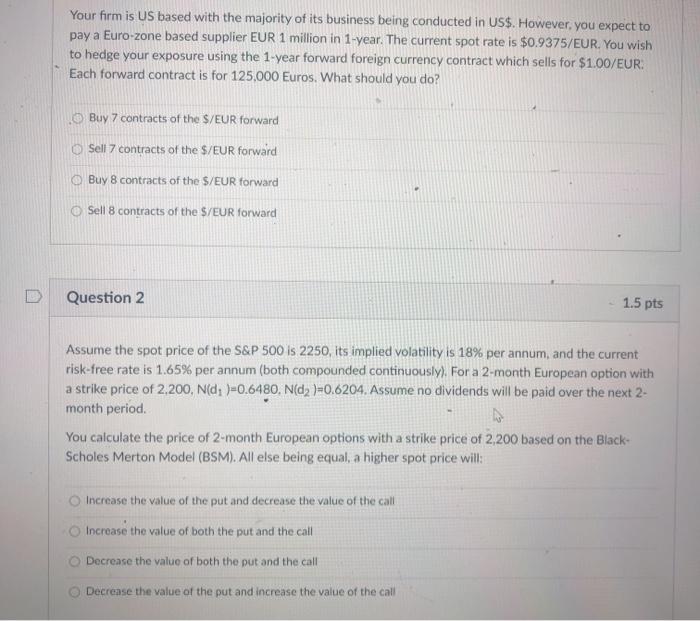

Your firm is US based with the majority of its business being conducted in US$. However, you expect to pay a Euro-zone based supplier EUR 1 million in 1-year. The current spot rate is $0.9375/EUR. You wish to hedge your exposure using the 1-year forward foreign currency contract which sells for $1.00/EUR. Each forward contract is for 125.000 Euros. What should you do? Buy 7 contracts of the $/EUR forward Sell 7 contracts of the $/EUR forward Buy 8 contracts of the $/EUR forward Sell 8 contracts of the S/EUR forward D Question 2 1.5 pts Assume the spot price of the S&P 500 is 2250, its implied volatility is 18% per annum, and the current risk-free rate is 1.65% per annum (both compounded continuously). For a 2-month European option with a strike price of 2.200, Nd, -0.6480, Nd2 )=0.6204. Assume no dividends will be paid over the next 2- month period. You calculate the price of 2-month European options with a strike price of 2,200 based on the Black- Scholes Merton Model (BSM). All else being equal, a higher spot price will: Increase the value of the put and decrease the value of the call Increase the value of both the put and the call Decrease the value of both the put and the call Decrease the value of the put and increase the value of the call

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts