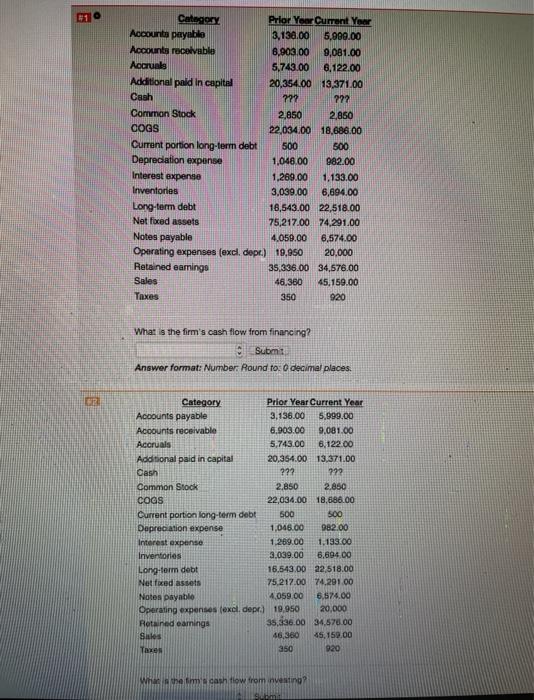

Question: please answer both, they're intertwined. Category Prior Year Current Year Accounts payablo 3,130.00 5,999.00 Accounts receivable 6.903.00 9,081.00 Accruals 5,743.00 6,122.00 Additional paid in capital

Category Prior Year Current Year Accounts payablo 3,130.00 5,999.00 Accounts receivable 6.903.00 9,081.00 Accruals 5,743.00 6,122.00 Additional paid in capital 20,354.00 13,371.00 Cash ??? Common Stock 2,850 2,850 COGS 22,034.00 18.686.00 Current portion long-term debt 500 500 Depreciation expense 1,048.00 982.00 Interest expense 1.269.00 1,133.00 Inventories 3,039.00 6,694.00 Long-term debt 18,543.00 22,518.00 Net foxed assets 75,217.00 74,291.00 Notes payable 4.059.00 6,574.00 Operating expenses (excl. depr.) 19.950 20.000 Retained earnings 35,336.00 34,576.00 Sales 46,360 45.159.00 Taxes 350 920 What is the firm's cash flow from financing? Subm: Answer format: Number: Round to: O decimal places. GR Category Prior Year Current Year Acoounts payable 3,136.00 5,999.00 Accounts receivable 6.903.00 9.081.00 Accruals 5,743.00 6,122.00 Additional paid in capital 20,364.00 13.371.00 Cash ??? 999 Common Stock 2.850 2.850 COGS 22,034.00 18.686.00 Current portion long-term debt 500 500 Depreciation expense 1,046.00 982.00 Interest expense 1,289.00 1.133.00 Inventories 3.039.00 6.694.00 Long form debt 16.543.00 22,518.00 Netfred assets 75.217.00 74.291.00 Notes payablo 4.059.00 6,574.09 Operating expenses (excl. depr.) 10.950 20,000 Retained earnings 35,836.00 34.570.00 Sile's 46.360 45,150.00 Taxe 350 920 What they cash flow from investing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts