Question: please show the calculations (without excel) You are given the following information on stock of two companies: Company A and Company B. Asset Standard deviation

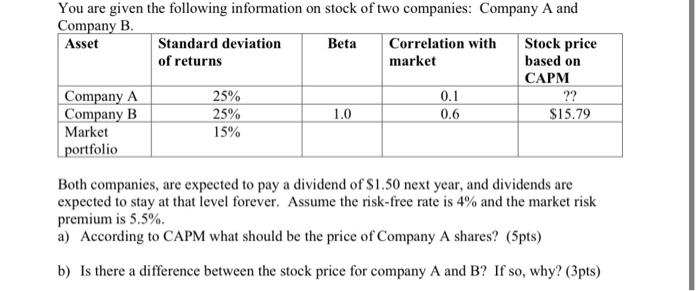

You are given the following information on stock of two companies: Company A and Company B. Asset Standard deviation Beta Correlation with Stock price of returns market based on CAPM Company A 25% ?? Company B 25% 1.0 0.6 $15.79 Market 15% portfolio 0.1 Both companies, are expected to pay a dividend of $1.50 next year, and dividends are expected to stay at that level forever. Assume the risk-free rate is 4% and the market risk premium is 5.5%. a) According to CAPM what should be the price of Company A shares? (5pts) b) Is there a difference between the stock price for company A and B? If so, why? (3pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts