Question: Please answer both! Thumbs up! An auto plant that costs $55 million to build can produce a new line of cars that will produce net

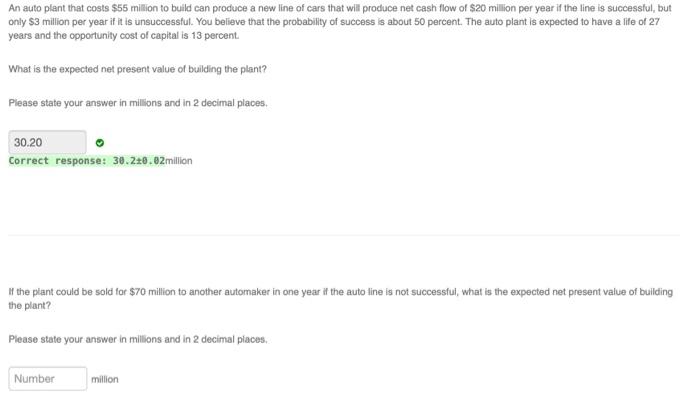

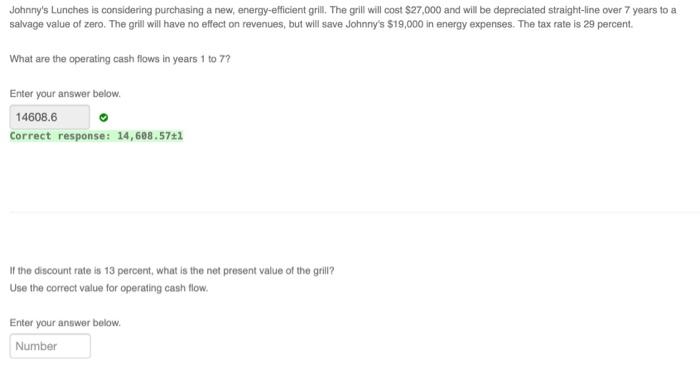

An auto plant that costs $55 million to build can produce a new line of cars that will produce net cash flow of $20 million per year if the line is successful, but only $3 million per year if it is unsuccessful. You believe that the probability of success is about 50 percent. The auto plant is expected to have a life of 27 years and the opportunity cost of capital is 13 percent. What is the expected net present value of building the plant? Please state your answer in millions and in 2 decimal places 30.20 Correct response: 38.228.2 million If the plant could be sold for $70 million to another automaker in one year if the auto line is not successful, what is the expected net present value of building the plant? Please state your answer in millions and in 2 decimal places, Number million Johnny's Lunches is considering purchasing a new, energy-efficient grill. The grill will cost $27,000 and will be depreciated straight-line over 7 years to a salvage value of zero. The grill will have no effect on revenues, but will save Johnny's 519,000 in energy expenses. The tax rate is 29 percent What are the operating cash flows in years 1 to 7? Enter your answer below. 14608.6 Correct response: 14,688.5741 if the discount rate is 13 percent, what is the net present value of the grill? Use the correct value for operating cash flow. Enter your answer below Number

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts