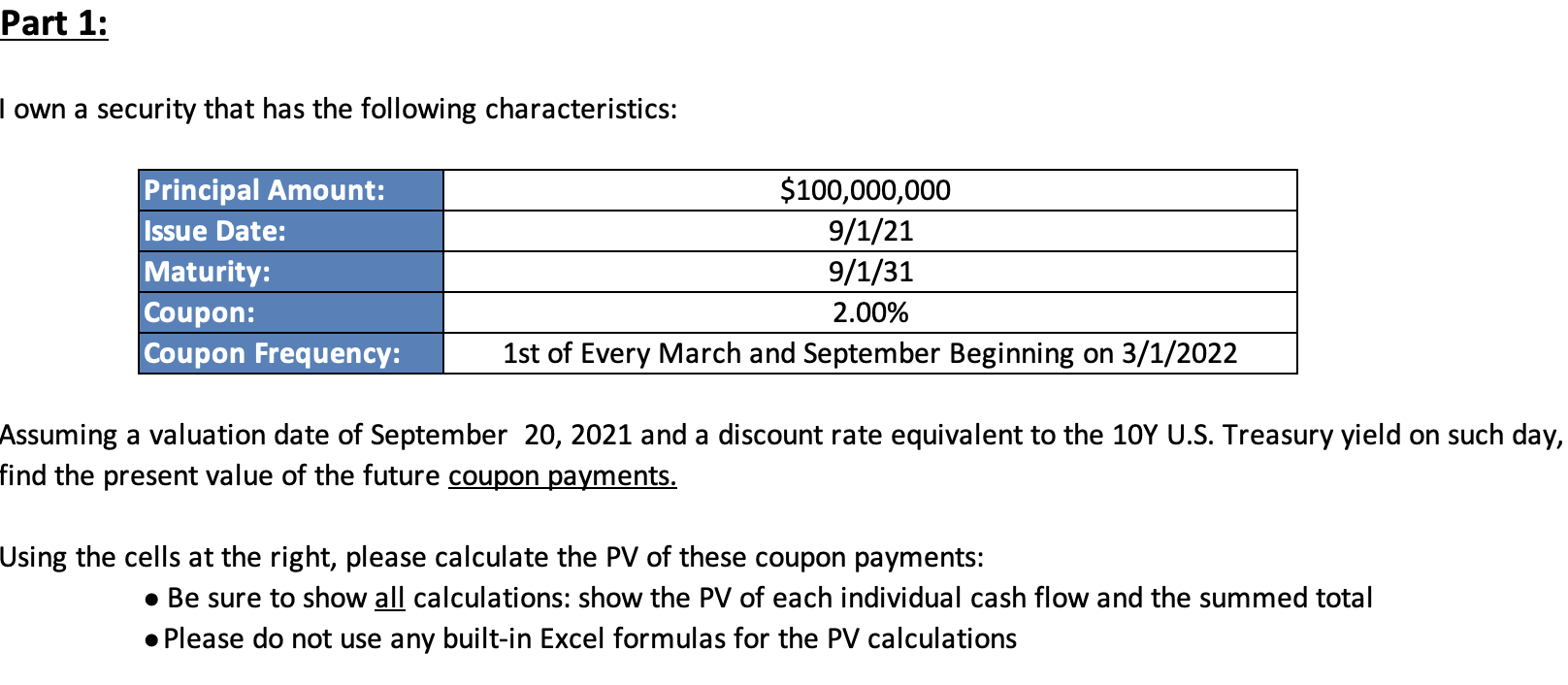

Question: PLEASE ANSWER BOTH USING EXCEL Part 1: I own a security that has the following characteristics: Principal Amount: Issue Date: Maturity: Coupon: Coupon Frequency: $100,000,000

PLEASE ANSWER BOTH USING EXCEL

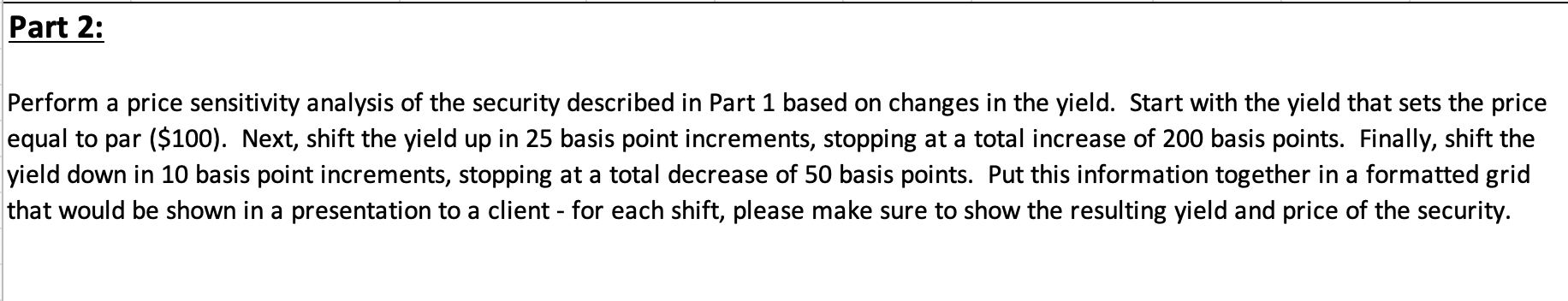

Part 1: I own a security that has the following characteristics: Principal Amount: Issue Date: Maturity: Coupon: Coupon Frequency: $100,000,000 9/1/21 9/1/31 2.00% 1st of Every March and September Beginning on 3/1/2022 Assuming a valuation date of September 20, 2021 and a discount rate equivalent to the 10Y U.S. Treasury yield on such day, find the present value of the future coupon payments. Using the cells at the right, please calculate the PV of these coupon payments: Be sure to show all calculations: show the PV of each individual cash flow and the summed total Please do not use any built-in Excel formulas for the PV calculations Part 2: Perform a price sensitivity analysis of the security described in Part 1 based on changes in the yield. Start with the yield that sets the price equal to par ($100). Next, shift the yield up in 25 basis point increments, stopping at a total increase of 200 basis points. Finally, shift the yield down in 10 basis point increments, stopping at a total decrease of 50 basis points. Put this information together in a formatted grid that would be shown in a presentation to a client - for each shift, please make sure to show the resulting yield and price of the security

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts