Question: Please answer completely Also include explanation of mathematical formula used to obtain the answer so that I may learn and practice. Make sure if using

Please answer completely

Also include explanation of mathematical formula used to obtain the answer so that I may learn and practice.

Make sure if using a financial calculator tell me the formula used and numbers to input.

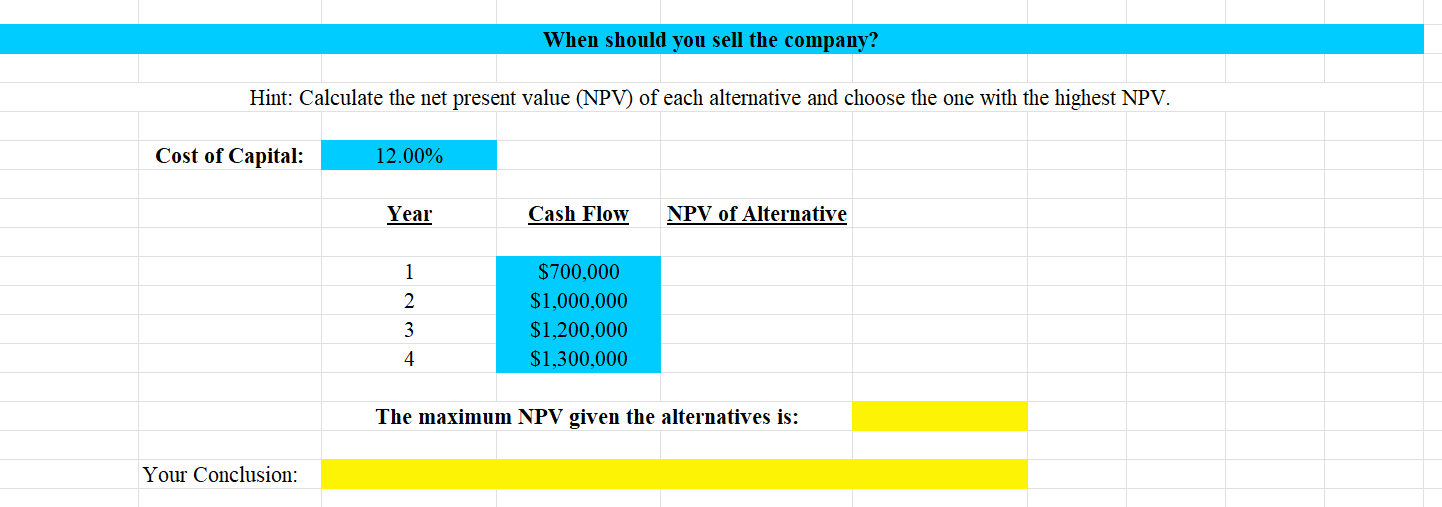

Predator, LLC a leveraged buyout specialist, recently bought a company and wants to determine the optimal time to sell it The partner is charge of this investment has estimated the aftertax cash flows at different times as follows: $ if sold one year later; $ if sold two years later; $ if sold three years later; and $ if sold four years later. The opportunity cost of capital is percent.

When should Predator sell the company? Why?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock