Question: please answer correctly and show workings. Let's use the shortcut formula called the Gordon Constant Growth model to calculate the value of Stock A from

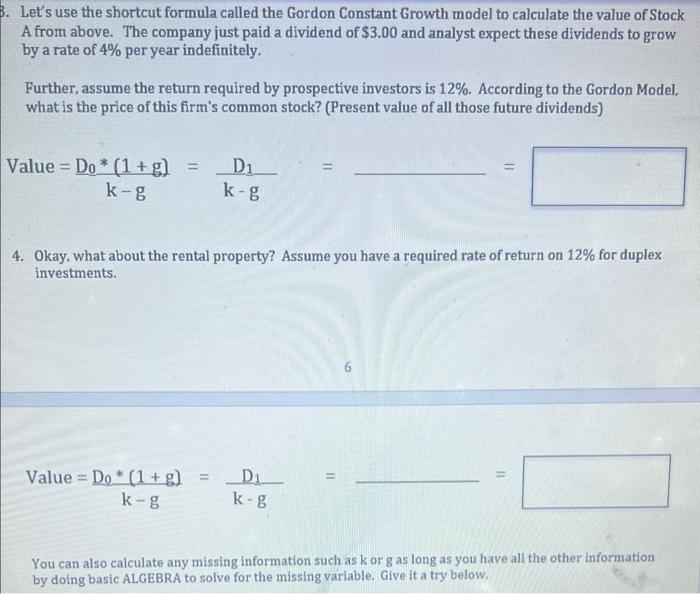

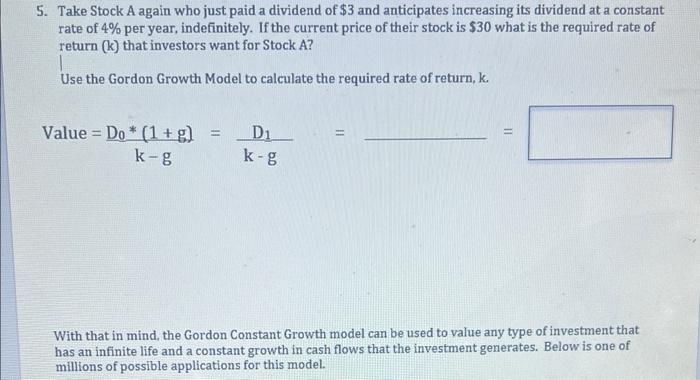

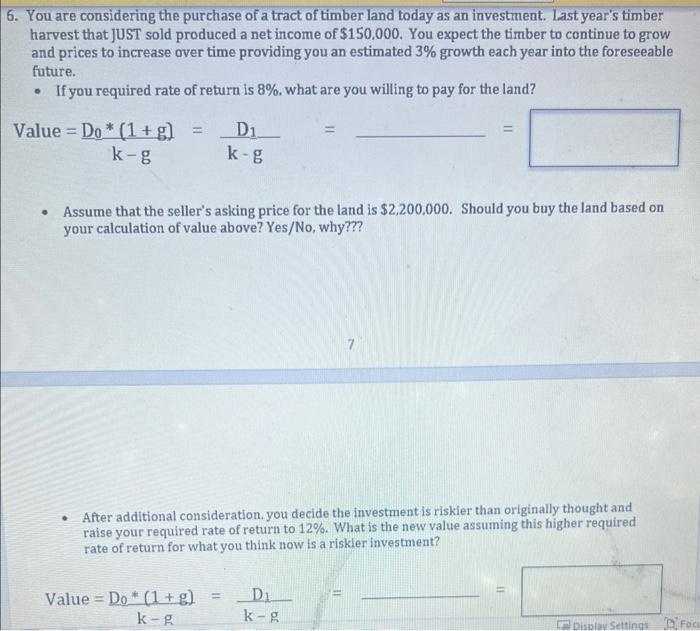

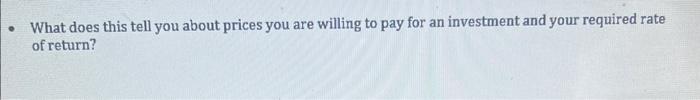

Let's use the shortcut formula called the Gordon Constant Growth model to calculate the value of Stock A from above. The company just paid a dividend of $3.00 and analyst expect these dividends to grow by a rate of 4% per year indefinitely. Further, assume the return required by prospective investors is 12%. According to the Gordon Model, what is the price of this firm's common stock? (Present value of all those future dividends) Value =kgD0(1+g)=kgD1= 4. Okay, what about the rental property? Assume you have a required rate of return on 12% for duplex investments. Value=kgD0(1+g)=kgD1= You can also calculate any missing information such as k or g as long as you have all the other information by doing basic ALGEBRA to solve for the missing variable. Give it a try below. 5. Take Stock A again who just paid a dividend of $3 and anticipates increasing its dividend at a constant rate of 4% per year, indefinitely. If the current price of their stock is $30 what is the required rate of return (k) that investors want for Stock A? Use the Gordon Growth Model to calculate the required rate of return, k. Value=kgD0(1+g)=kgD1= With that in mind, the Gordon Constant Growth model can be used to value any type of investment that has an infinite life and a constant growth in cash flows that the investment generates. Below is one of millions of possible applications for this model. 6. You are considering the purchase of a tract of timber land today as an investment. Last year's timber harvest that JUST sold produced a net income of $150.000. You expect the timber to continue to grow and prices to increase over time providing you an estimated 3% growth each year into the foreseeable future. - If you required rate of return is 8%, what are you willing to pay for the land? Value=kgD0(1+g)=kgD1= - Assume that the seller's asking price for the land is $2,200,000. Should you buy the land based on your calculation of value above? Yes/No, why??? 7 - After additional consideration you decide the investment is riskier than originally thought and raise your required rate of return to 12%. What is the new value assuming this higher required rate of return for what you think now is a riskler investment? Value=kgD0(1+g)=kgD1= What does this tell you about prices you are willing to pay for an investment and your required rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts