Question: please answer question 4 only and show the workings. 3. Let's use the shortcut formula called the Gordon Constant Growth model to calculate the value

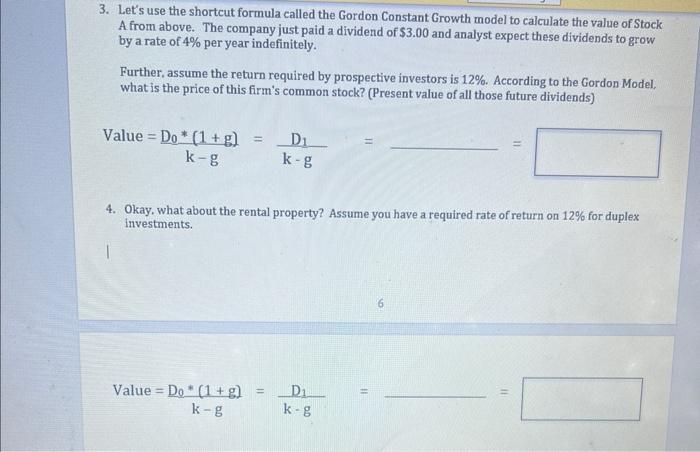

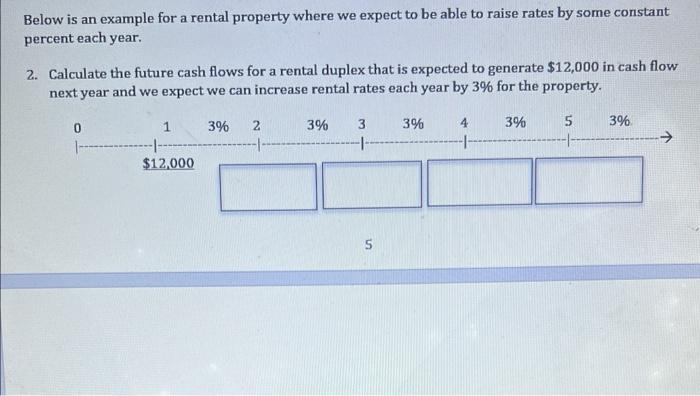

3. Let's use the shortcut formula called the Gordon Constant Growth model to calculate the value of Stock A from above. The company just paid a dividend of $3.00 and analyst expect these dividends to grow by a rate of 4% per year indefinitely. Further, assume the return required by prospective investors is 12%. According to the Gordon Model, what is the price of this firm's common stock? (Present value of all those future dividends) Value=kgD0(1+g)=kgD1= 4. Okay, what about the rental property? Assume you have a required rate of return on 12% for duplex investments. Value=kgD0(1+g)=kgD1= Below is an example for a rental property where we expect to be able to raise rates by some constant percent each year. 2. Calculate the future cash flows for a rental duplex that is expected to generate $12,000 in cash flow next year and we expect we can increase rental rates each year by 3% for the property

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts