Question: please answer correctly and show workings. Thank you (c) Compute net operating assets (NOA) for 2016. Note, for the balance sheet items of Cisco Systems,

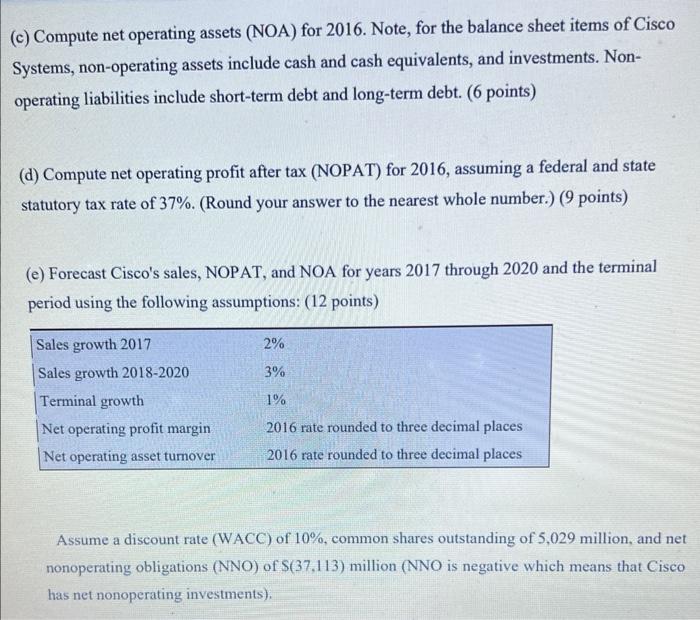

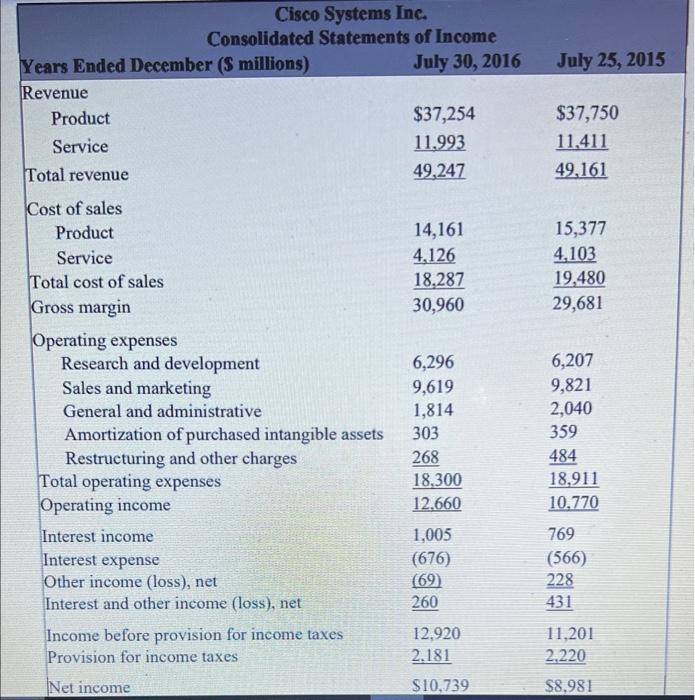

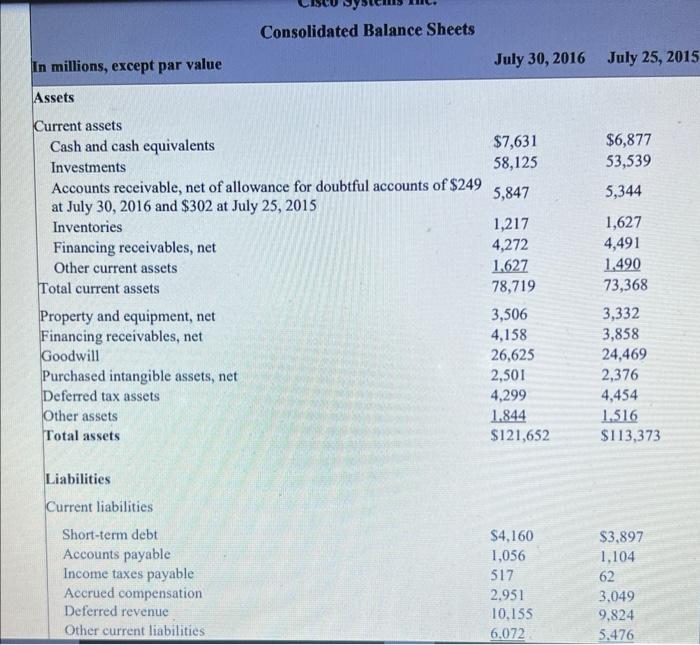

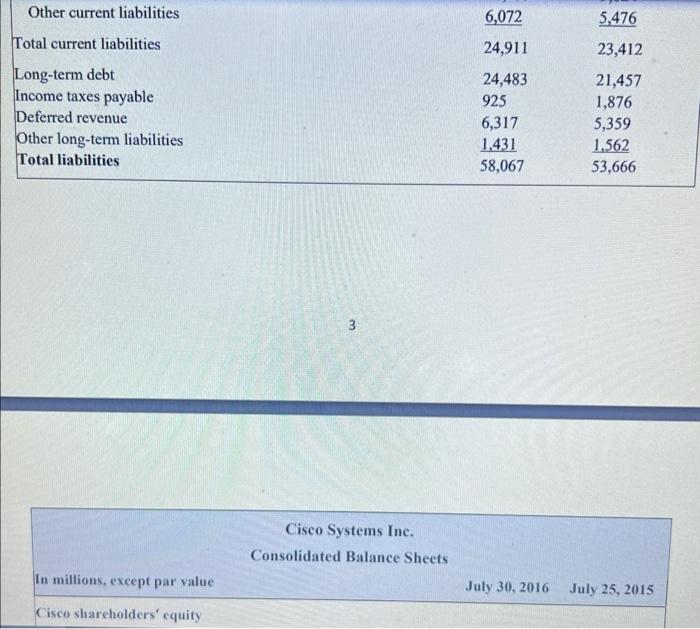

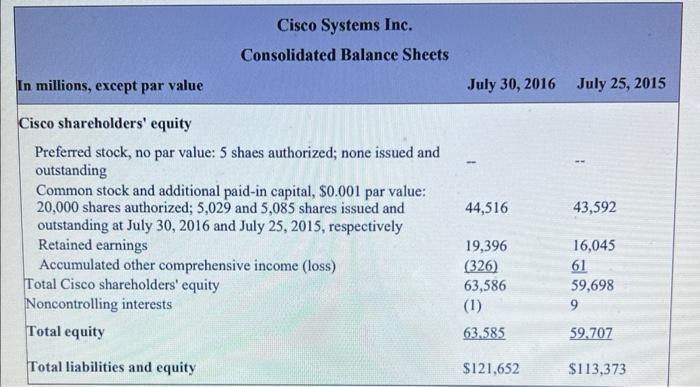

(c) Compute net operating assets (NOA) for 2016. Note, for the balance sheet items of Cisco Systems, non-operating assets include cash and cash equivalents, and investments. Nonoperating liabilities include short-term debt and long-term debt. (6 points) (d) Compute net operating profit after tax (NOPAT) for 2016, assuming a federal and state statutory tax rate of 37%. (Round your answer to the nearest whole number.) ( 9 points) (e) Forecast Cisco's sales, NOPAT, and NOA for years 2017 through 2020 and the terminal period using the following assumptions: ( 12 points) Assume a discount rate (WACC) of 10\%, common shares outstanding of 5,029 million, and net nonoperating obligations (NNO) of $(37,113) million (NNO is negative which means that C isco has net nonoperating investments). Consolidated Balance Sheets July 30, 2016 July 25, 2015 \begin{tabular}{lll} \multicolumn{1}{|c}{ Other current liabilities } & 6,072 & 5,476 \\ Total current liabilities & 24,911 & 23,412 \\ Long-term debt & 24,483 & 21,457 \\ Income taxes payable & 925 & 1,876 \\ Deferred revenue & 6,317 & 5,359 \\ Other long-term liabilities & 1,431 & 1,562 \\ Total liabilities & 58,067 & 53,666 \\ \hline \end{tabular} 3 Cisco Systems Inc. Consolidated Balance Sheets In millions, except par value July 30, 2016 July 25,2015 Cisco shareholders' equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts