Question: Please answer correctly. Similar problem with different numbers has been asked and answered correctly on Chegg. Follow that previous problem if needed. Thanks In mid-May,

Please answer correctly. Similar problem with different numbers has been asked and answered correctly on Chegg. Follow that previous problem if needed. Thanks

Please answer correctly. Similar problem with different numbers has been asked and answered correctly on Chegg. Follow that previous problem if needed. Thanks

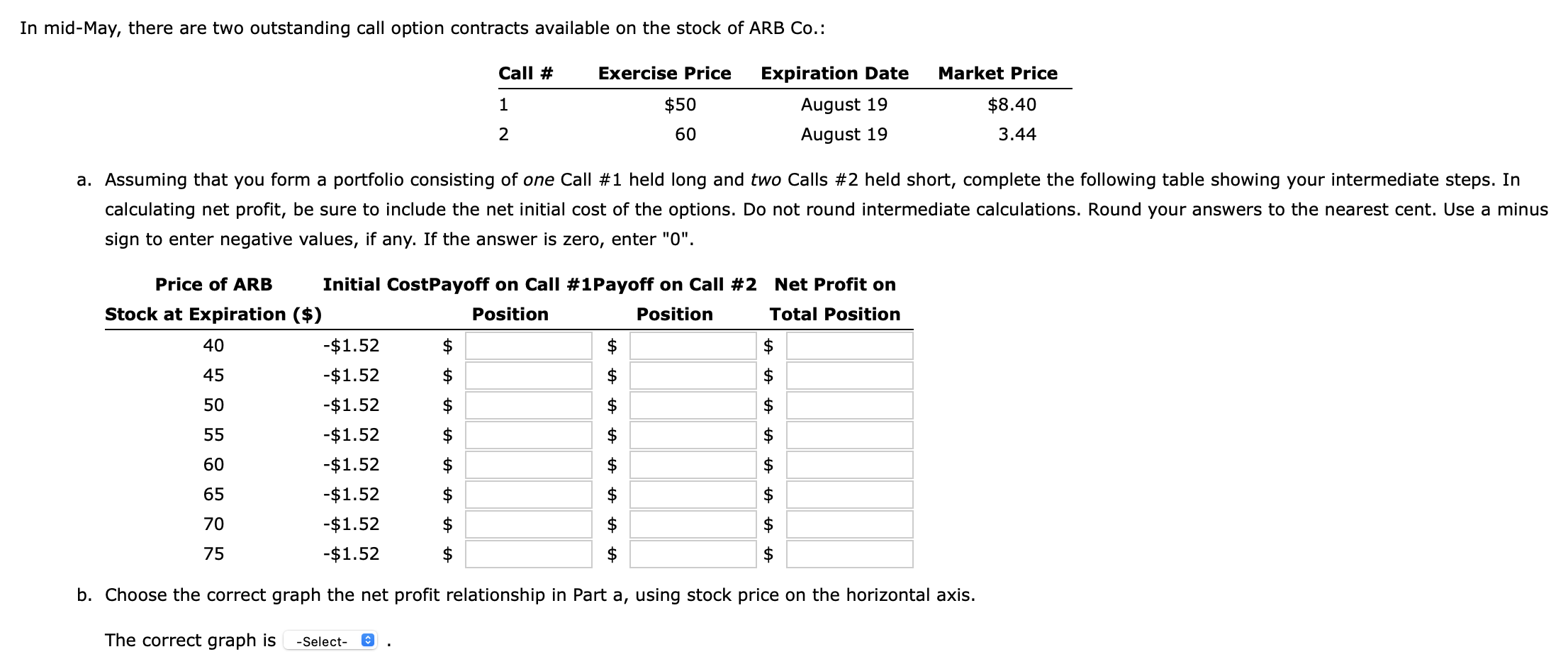

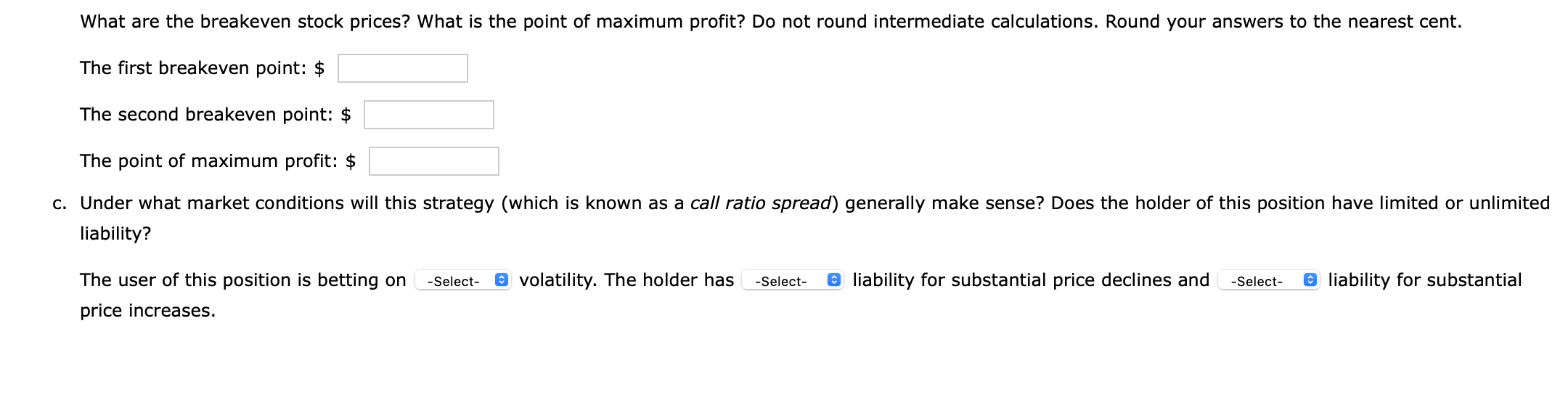

In mid-May, there are two outstanding call option contracts available on the stock of ARB Co.: a. Assuming that you form a portfolio consisting of one Call \# 1 held long and two Calls \#2 held short, complete the following table showing your intermediate steps. In calculating net profit, be sure to include the net initial cost of the options. Do not round intermediate calculations. Round your answers to the nearest cent. Use a minus sign to enter negative values, if any. If the answer is zero, enter "0". b. Choose the correct graph the net profit relationship in Part a, using stock price on the horizontal axis. The correct graph is What are the breakeven stock prices? What is the point of maximum profit? Do not round intermediate calculations. Round your answers to the nearest cent. The first breakeven point: $ The second breakeven point: \$ The point of maximum profit: $ c. Under what market conditions will this strategy (which is known as a call ratio spread) generally make sense? Does the holder of this position have limited or unlimite liability? The user of this position is betting on volatility. The holder has liability for substantial price declines and liability for substantial price increases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts