Question: please answer correctly with all working D Question 13 1 pts Amanda is self-employed and works in Idaho. She recently went on a trip to

please answer correctly with all working

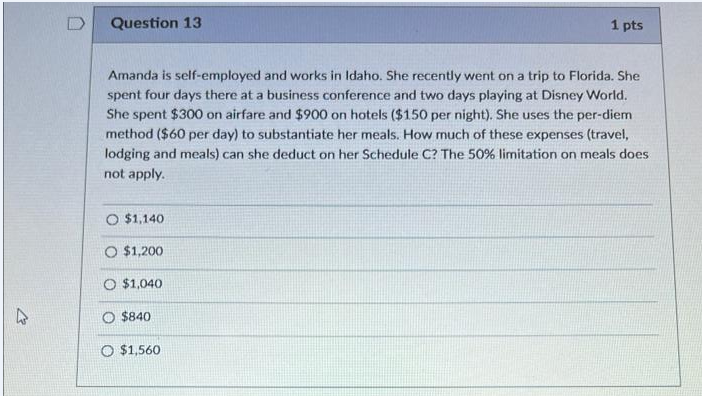

D Question 13 1 pts Amanda is self-employed and works in Idaho. She recently went on a trip to Florida. She spent four days there at a business conference and two days playing at Disney World. She spent $300 on airfare and $900 on hotels ($150 per night). She uses the per-diem method ($60 per day) to substantiate her meals. How much of these expenses (travel, lodging and meals) can she deduct on her Schedule C? The 50% limitation on meals does not apply. O $1,140 O $1,200 O $1,040 O $840 O $1,560

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts