Question: please answer correctly You have estimated the single index model (SIM) for Fund B and found that its alpha and beta are 0.035 and 1.1

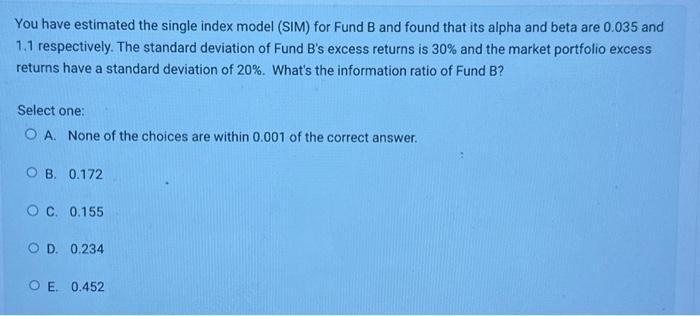

You have estimated the single index model (SIM) for Fund B and found that its alpha and beta are 0.035 and 1.1 respectively. The standard deviation of Fund B's excess returns is 30% and the market portfolio excess returns have a standard deviation of 20%. What's the information ratio of Fund B ? Select one: A. None of the choices are within 0.001 of the correct answer. B. 0.172 C. 0.155 D. 0.234 E. 0.452

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts