Question: Please answer e and f Q-3. The following information regarding two stocks X and Y are provided below: Years X Y 2010 10% 35% 2011

Please answer e and f

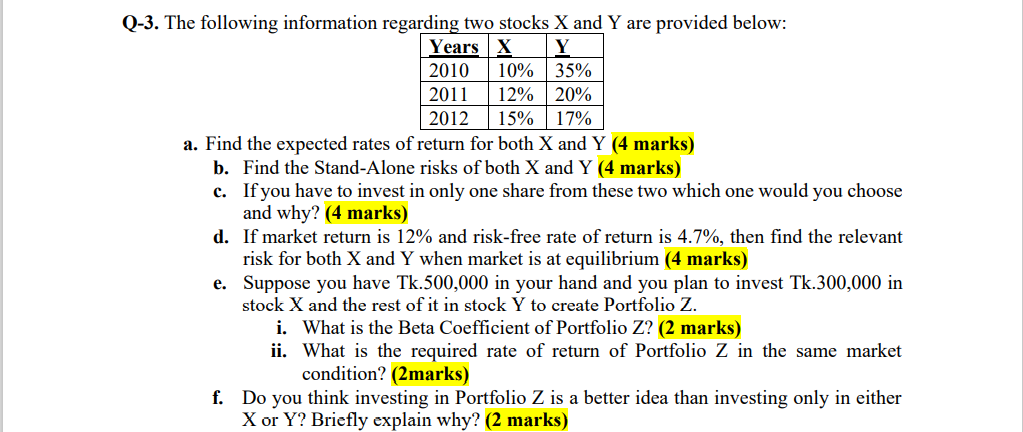

Q-3. The following information regarding two stocks X and Y are provided below: Years X Y 2010 10% 35% 2011 12% 20% 2012 15% 17% a. Find the expected rates of return for both X and Y (4 marks) b. Find the Stand-Alone risks of both X and Y (4 marks) c. If you have to invest in only one share from these two which one would you choose and why? (4 marks) d. If market return is 12% and risk-free rate of return is 4.7%, then find the relevant risk for both X and Y when market is at equilibrium (4 marks) e. Suppose you have Tk.500,000 in your hand and you plan to invest Tk.300,000 in stock X and the rest of it in stock Y to create Portfolio Z. i. What is the Beta Coefficient of Portfolio Z? (2 marks) ii. What is the required rate of return of Portfolio Z in the same market condition? (2marks) f. Do you think investing in Portfolio Z is a better idea than investing only in either X or Y? Briefly explain why? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts