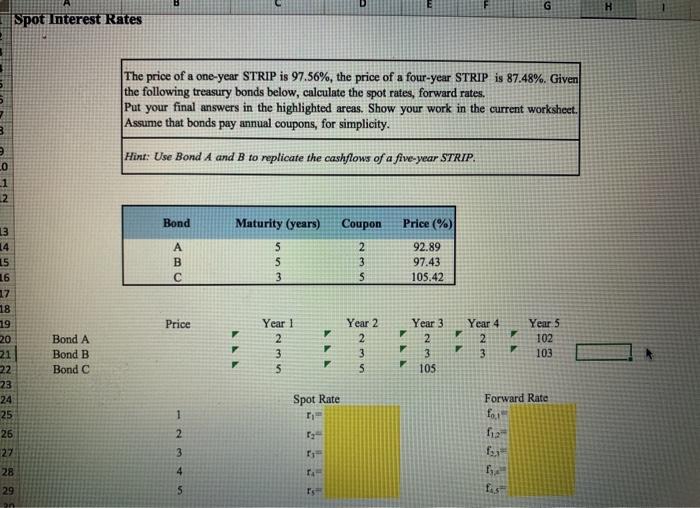

Question: please do thru excel if you could show formulas as well please G H Spot Interest Rates The price of a one-year STRIP is 97.56%,

G H Spot Interest Rates The price of a one-year STRIP is 97.56%, the price of a four-year STRIP is 87.48%. Given the following treasury bonds below, calculate the spot rates, forward rates. Put your final answers in the highlighted areas. Show your work in the current worksheet. Assume that bonds pay annual coupons, for simplicity. 3 Hint: Use Bond A and B to replicate the cashflows of a five-year STRIP. 0 1 2 Bond Coupon Price (%) A B Maturity (years) 5 5 3 | 92.89 97.43 105.42 Price 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 Bond A Bond B Bond C NAN Year 1 2 3 5 Year 2 2 3 5 Year 3 2 3 105 Year 4 2 3 7 F Year 5 102 103 Spot Rate Forward Rate 1 fo, f12 AN- 28 29 5 The price of a one-year STRIP is 97.56%, the price of a four-year STRIP is 87.48%. Given the following treasury bonds below, calculate the spot rates, forward rates. Put your final answers in the highlighted areas. Show your work in the current worksheet. Assume that bonds pay annual coupons, for simplicity. Hint: Use Bond A and B to replicate the cashflows of a five-year STRIP

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts