Question: PLEASE ANSWER E ONLY. THANK YOU! 7. The following are monthly percentage price changes for four market indexes: Month DJIA S&P 500 Nikkei 1 2

PLEASE ANSWER E ONLY. THANK YOU!

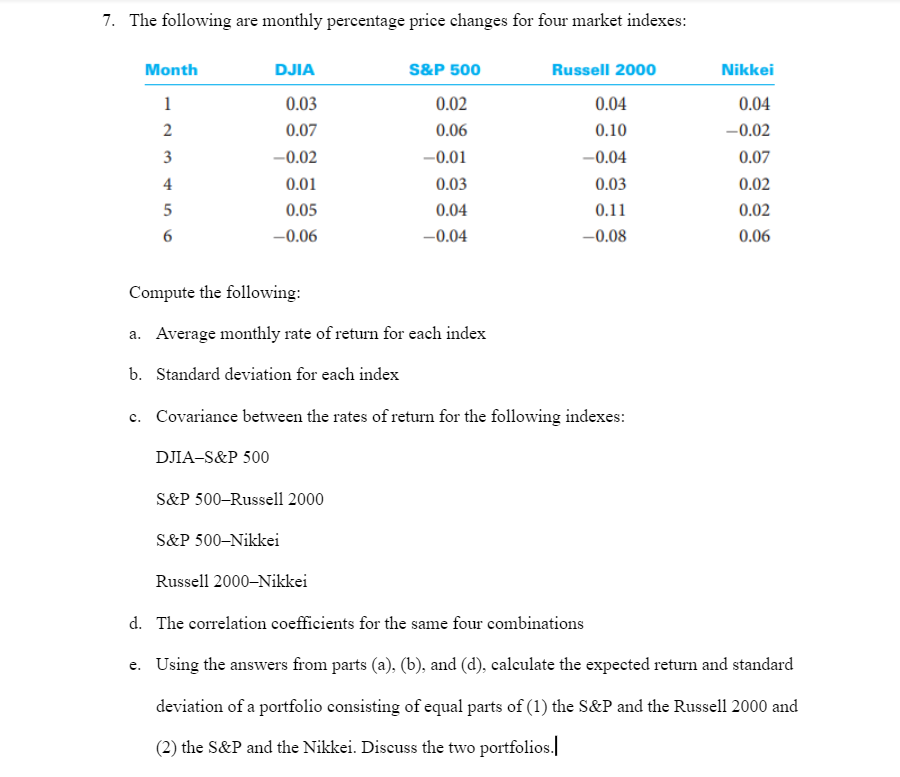

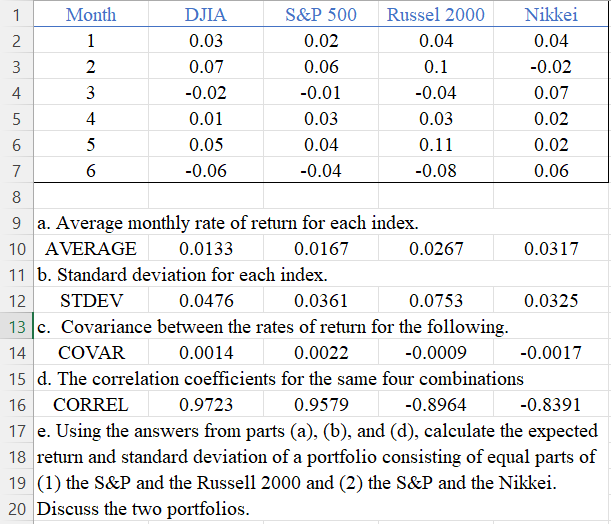

7. The following are monthly percentage price changes for four market indexes: Month DJIA S&P 500 Nikkei 1 2 3 4 5 6 0.03 0.07 -0.02 0.01 0.05 -0.06 0.02 0.06 -0.01 0.03 0.04 -0.04 Russell 2000 0.04 0.10 -0.04 0.03 0.11 -0.08 0.04 -0.02 0.07 0.02 0.02 0.06 Compute the following: a. Average monthly rate of return for each index b. Standard deviation for each index c. Covariance between the rates of return for the following indexes: DJIA-S&P 500 S&P 500Russell 2000 S&P 500-Nikkei Russell 2000-Nikkei d. The correlation coefficients for the same four combinations e. Using the answers from parts (a), (b), and (d), calculate the expected return and standard deviation of a portfolio consisting of equal parts of (1) the S&P and the Russell 2000 and (2) the S&P and the Nikkei. Discuss the two portfolios. N 4. 1 Month DJIA S&P 500 Russel 2000 Nikkei 1 0.03 0.02 0.04 0.04 3 2 0.07 0.06 0.1 -0.02 3 -0.02 -0.01 -0.04 0.07 5 4 0.01 0.03 0.03 0.02 6 5 0.05 0.04 0.11 0.02 7 6 -0.06 -0.04 -0.08 0.06 8 9 a. Average monthly rate of return for each index. 10 AVERAGE 0.0133 0.0167 0.0267 0.0317 11 b. Standard deviation for each index. 12 STDEV 0.0476 0.0361 0.0753 0.0325 13. c. Covariance between the rates of return for the following. 14 COVAR 0.0014 0.0022 -0.0009 -0.0017 15 d. The correlation coefficients for the same four combinations 16 CORREL 0.9723 0.9579 -0.8964 -0.8391 17 e. Using the answers from parts (a), (b), and (d), calculate the expected 18 return and standard deviation of a portfolio consisting of equal parts of 19 (1) the S&P and the Russell 2000 and (2) the S&P and the Nikkei. 20 Discuss the two portfolios

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts