Question: Please answer each part fully and clearly for a good review. Show solutions for the estimated market risk, firm specific risk, and total risk of

Please answer each part fully and clearly for a good review. Show solutions for the estimated market risk, firm specific risk, and total risk of the portfolio of securities A, B, and C. I have posted the answers to each part below but need the solutions to get to each answer. Thank you.

Portfolio Beta: 0.7785

Variance of error term (Firm Specific Risk): 17.805

Market Risk: 136.36

Total Risk Variance: 154.165

Total Risk Standard Deviation: 12.42%

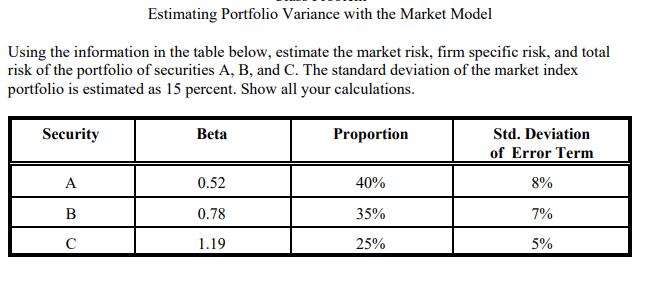

Estimating Portfolio Variance with the Market Model Using the information in the table below, estimate the market risk, firm specific risk, and total risk of the portfolio of securities A, B, and C. The standard deviation of the market index portfolio is estimated as 15 percent. Show all your calculations. Security Beta Proportion Std. Deviation 0.52 0.78 1.19 40% 35% 25% of Error Term 8% 7% 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts