Question: PLEASE ANSWER EACH PART LABELING EACH PART (Example: E12-25 ANSWER) ANSWER E12-25 through E12-28 PLEASE!!!! C12-25. (True or False) State whether the following assertions are

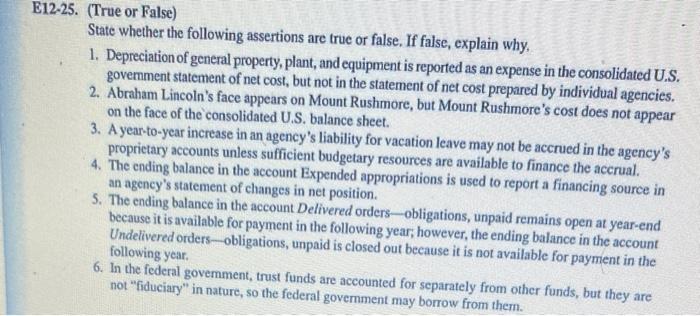

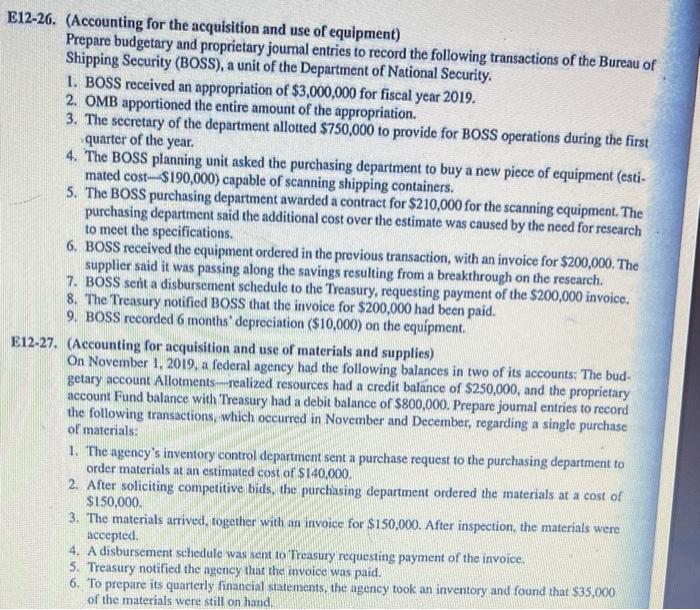

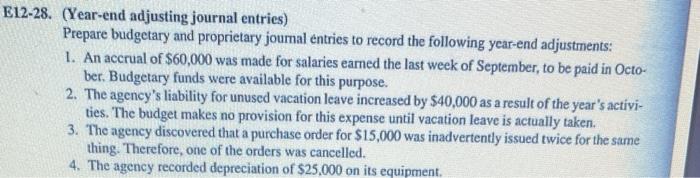

C12-25. (True or False) State whether the following assertions are true or false. If false, explain why. 1. Depreciation of general property, plant, and equipment is reported as an expense in the consolidated U.S. govemment statement of net cost, but not in the statement of net cost prepared by individual agencies. 2. Abraham Lincoln's face appears on Mount Rushmore, but Mount Rushmore's cost does not appear on the face of the consolidated U.S. balance sheet. 3. A year-to-year increase in an agency's liability for vacation leave may not be accrued in the agency's proprietary accounts unless sufficient budgetary resources are available to finance the accrual. 4. The ending balance in the account Expended appropriations is used to report a financing source in an agency's statement of changes in net position. 5. The ending balance in the account Delivered orders - obligations, unpaid remains open at year-end because it is available for payment in the following year; however, the ending balance in the account Undelivered orders - obligations, unpaid is closed out because it is not available for payment in the following year. 6. In the federal govemment, trust funds are accounted for separately from other funds, but they are not "fiduciary" in nature, so the federal government may borrow from them. E12-26. (Accounting for the acquisition and use of equipment) Prepare budgetary and proprietary joumal entries to record the following transactions of the Bureau of Shipping Security (BOSS), a unit of the Department of National Security. 1. BOSS received an appropriation of $3,000,000 for fiscal year 2019. 2. OMB apportioned the entire amount of the appropriation. 3. The secretary of the department allotted $750,000 to provide for BOSS operations during the first quarter of the year. 4. The BOSS planning unit asked the purchasing department to buy a new piece of equipment (estimated cost $190,000 ) capable of scanning shipping containers. 5. The BOSS purchasing department awarded a contract for $210,000 for the scanning equipment. The purchasing department said the additional cost over the estimate was caused by the need for research to meet the specifications. 6. BOSS received the equipment ordered in the previous transaction, with an invoice for $200,000. The supplier said it was passing along the savings resulting from a breakthrough on the research. 7. BOSS sen't a disbursement schedule to the Treasury, requesting payment of the $200,000 invoice. 8. The Treasury notified BOSS that the invoice for $200,000 had been paid. 9. BOSS recorded 6 months' depreciation ($10,000) on the equipment. E12-27. (Accounting for acquisition and use of materials and supplies) On November 1, 2019, a federal agency had the following balances in two of its accounts: The budgetary account Allotments-realized resources had a credit balance of $250,000, and the proprietary account Fund balance with Treasury had a debit balance of $800,000. Prepare joumal entries to record the following transactions, which occurred in November and December, regarding a single purchase of materials: 1. The agency's inventory control department sent a purchase request to the purchasing department to order materials at an estimated cost of $140,000. 2. After soliciting competitive bids, the purchasing department ordered the materials at a cost of $150,000. 3. The materials arrived, together with an invoice for $150,000. After inspection, the materials were accepted. 4. A disbursement schedule was sent to Treasury requesting payment of the invoice. 5. Treasury notified the agency that the invoice was paid. 6. To prepare its quarterly financial statements, the agency took an inventory and foond that $35,000 of the materials were still on hand. 2-28. (Year-end adjusting journal entries) Prepare budgetary and proprietary journal entries to record the following year-end adjustments: 1. An accrual of $60,000 was made for salaries eamed the last week of September, to be paid in October. Budgetary funds were available for this purpose. 2. The agency's liability for unused vacation leave increased by $40,000 as a result of the year's activities. The budget makes no provision for this expense until vacation leave is actually taken. 3. The agency discovered that a purchase order for $15,000 was inadvertently issued twice for the same thing. Therefore, one of the orders was cancelled. 4. The agency recorded depreciation of $25,000 on its equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts