Question: Please answer entire quesion thread with explanations/equations and not hand written Thank you! I have so far: Calculating Project OCF H. Cochran, Inc., is considering

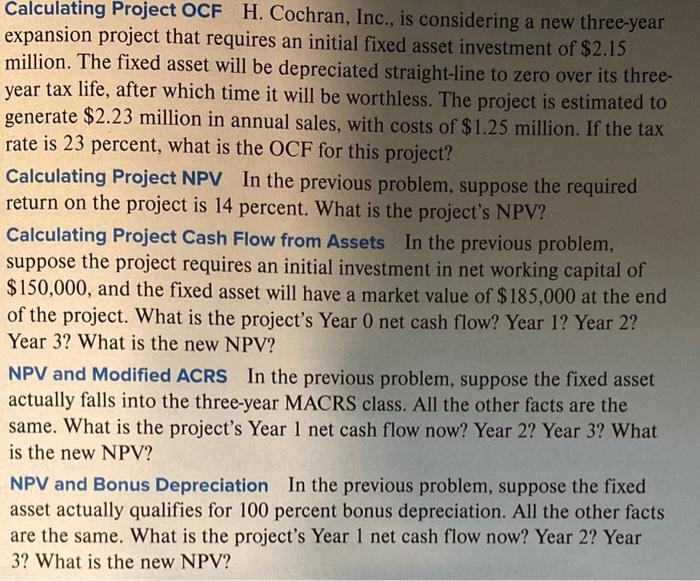

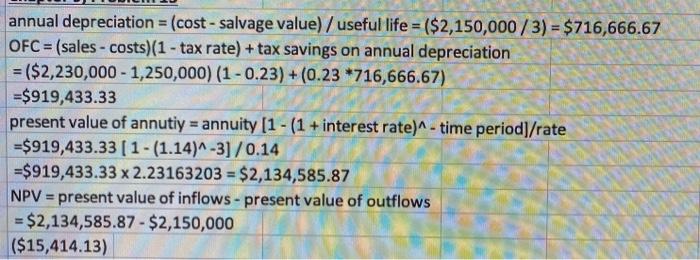

Calculating Project OCF H. Cochran, Inc., is considering a new three-year expansion project that requires an initial fixed asset investment of $2.15 million. The fixed asset will be depreciated straight-line to zero over its three- year tax life, after which time it will be worthless. The project is estimated to generate $2.23 million in annual sales, with costs of $1.25 million. If the tax rate is 23 percent, what is the OCF for this project? Calculating Project NPV In the previous problem, suppose the required return on the project is 14 percent. What is the project's NPV? Calculating Project Cash Flow from Assets In the previous problem, suppose the project requires an initial investment in net working capital of $150,000, and the fixed asset will have a market value of $185,000 at the end of the project. What is the project's Year 0 net cash flow? Year 12 Year 2? Year 3? What is the new NPV? NPV and Modified ACRS In the previous problem, suppose the fixed asset actually falls into the three-year MACRS class. All the other facts are the same. What is the project's Year 1 net cash flow now? Year 2? Year 3? What is the new NPV? NPV and Bonus Depreciation In the previous problem, suppose the fixed asset actually qualifies for 100 percent bonus depreciation. All the other facts are the same. What is the project's Year 1 net cash flow now? Year 2? Year 3? What is the new NPV? annual depreciation = (cost - salvage value) / useful life = ($2,150,000/3) = $716,666.67 OFC = (sales - costs)(1 - tax rate) + tax savings on annual depreciation = ($2,230,000 - 1,250,000) (1 -0.23)+(0.23 *716,666.67) =$919,433.33 present value of annutiy = annuity [1 - (1 + interest rate)^-time period]/rate =$919,433.33(1-(1.14)^-3] /0.14 =$919,433.33 x 2.23163203 = $2,134,585.87 NPV = present value of inflows - present value of outflows = $2,134,585.87 - $2,150,000 ($15,414.13)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts