Question: please answer E(Rp), Var(Rp) , and Std. Dev (Rp) % Thank you! -5% You have been given two different investments: Stock X and Stock Y.

please answer E(Rp), Var(Rp) , and Std. Dev (Rp) % Thank you!

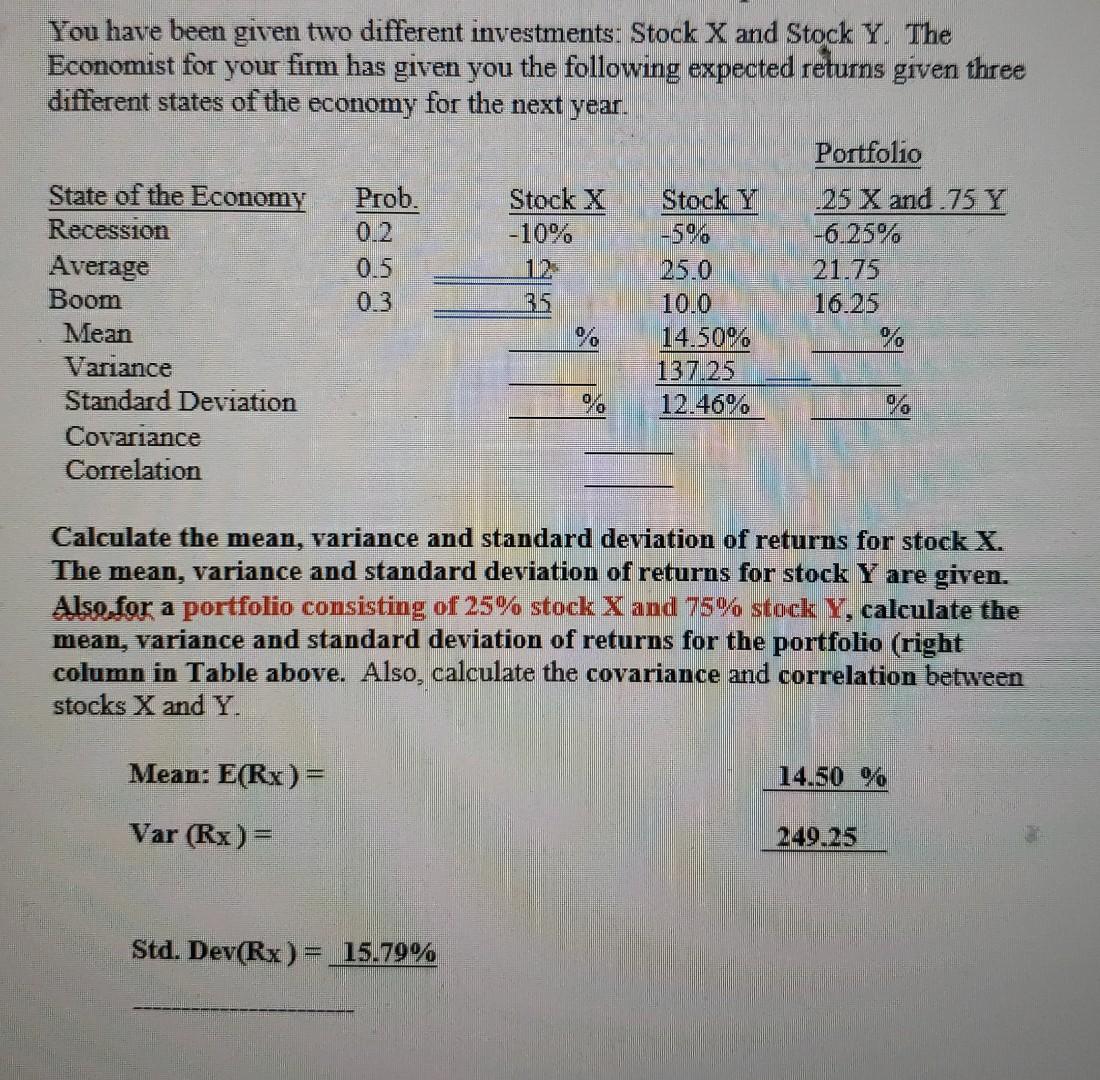

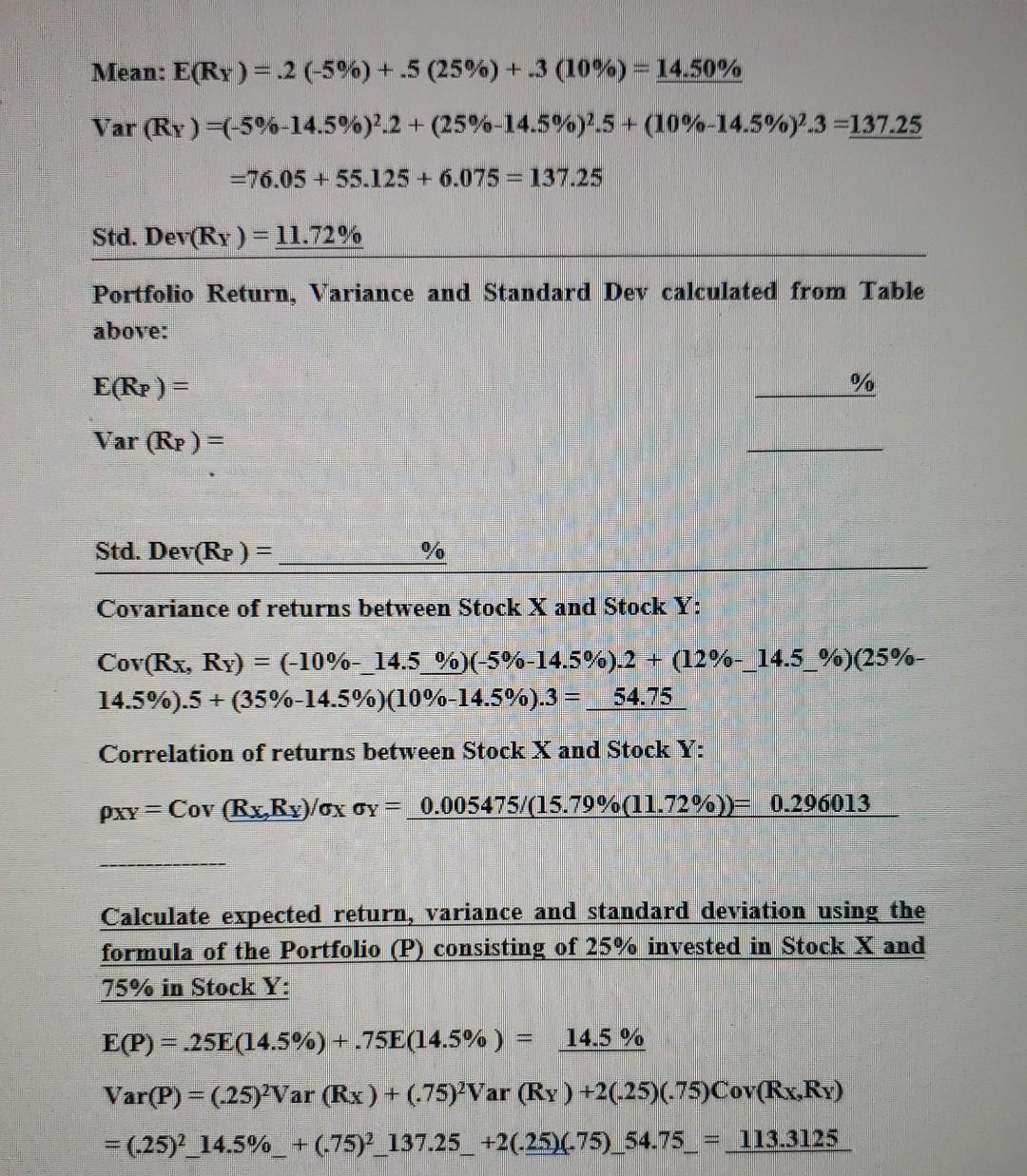

-5% You have been given two different investments: Stock X and Stock Y. The Economist for your firm has given you the following expected returns given three different states of the economy for the next year. Portfolio State of the Economy Prob. Stock X Stock Y 25 X and 75 Y Recession 0.2 -10% -6.25% Average 0.5 25.0 21.75 Boom 0.3 10.0 16.25 Mean 14.50% % Variance 137.25 Standard Deviation 12.46% % Covariance Correlation Calculate the mean, variance and standard deviation of returns for stock X. The mean, variance and standard deviation of returns for stock Y are given. Also for a portfolio consisting of 25% stock X and 75% stock Y, calculate the mean, variance and standard deviation of returns for the portfolio (right column in Table above. Also, calculate the covariance and correlation between stocks X and Y. Mean: E(Rx) = 14.50 % Var (Rx)= 249.25 Std. Dev(Rx) = 15.79% Mean: E(Ry) = 2 (-5%)+.5 (25%)+.3 (10%) = 14.50% Var (Ry)=(-5%-14.5%)2.2+(25%-14.5%).5+ (10%-14.5%) 3 =137.25 =76.05 + 55.125 +6.075 = 137.25 Std. Dev(Ry) = 11.72% Portfolio Return, Variance and Standard Dev calculated from Table above: E(Rp )= % Var (Rp ) = Std. Dev(Rp ) = % Covariance of returns between Stock X and Stock Y: Cov(Ry, Ry) = (-10%-_14.5 % (-5%-14.5%).2 + (12%-_14.5_%) (25%- 14.5%).5+ (35%-14.5%)(10%-14.5%).3= 54.75 Correlation of returns between Stock X and Stock Y: pxy=Cov (Ry, Ry/ox oy = 0.005475/(15.79%(11.72%)= 0.296013 Calculate expected return, variance and standard deviation using the formula of the Portfolio (P) consisting of 25% invested in Stock X and 75% in Stock Y: E(P) = -25E(14.5%) +.75E(14.5%) = 14.5 % Var(P) = (-25) Var (Rx ) + (.75) Var (Ry) +2(.25)(.75)Cov(Rx Ry) = (-25)2_14.5%_+ (175)?_137.25_ +2(-25)/275)_54.75_ 113.3125

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts