Question: Please answer every parts with steps. 3. One-Step Binomial Model Consider a 2-year European call with strike price $100. The current stock price is $100

Please answer every parts with steps.

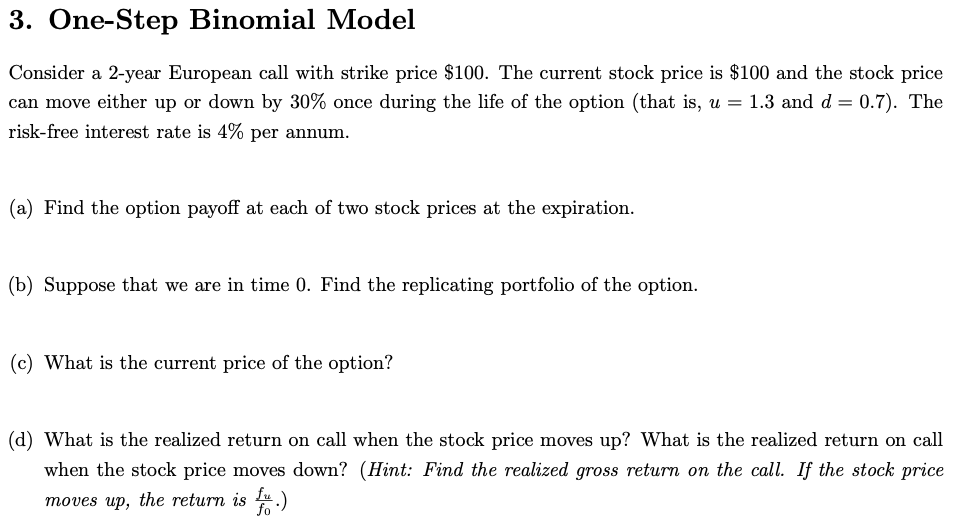

3. One-Step Binomial Model Consider a 2-year European call with strike price $100. The current stock price is $100 and the stock price can move either up or down by 30% once during the life of the option (that is, u = 1.3 and d = 0.7). The risk-free interest rate is 4% per annum. (a) Find the option payoff at each of two stock prices at the expiration. (b) Suppose that we are in time 0. Find the replicating portfolio of the option. (c) What is the current price of the option? (d) What is the realized return on call when the stock price moves up? What is the realized return on call when the stock price moves down? (Hint: Find the realized gross return on the call. If the stock price moves up, the return is fu.) fo 3. One-Step Binomial Model Consider a 2-year European call with strike price $100. The current stock price is $100 and the stock price can move either up or down by 30% once during the life of the option (that is, u = 1.3 and d = 0.7). The risk-free interest rate is 4% per annum. (a) Find the option payoff at each of two stock prices at the expiration. (b) Suppose that we are in time 0. Find the replicating portfolio of the option. (c) What is the current price of the option? (d) What is the realized return on call when the stock price moves up? What is the realized return on call when the stock price moves down? (Hint: Find the realized gross return on the call. If the stock price moves up, the return is fu.) fo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts