Question: Please answer everything and in detail as shown in the sheet. Please answer all the columns. Sandra Gilbert, Retiree 1. Calculate the aftertax proceeds from

Please answer everything and in detail as shown in the sheet. Please answer all the columns.

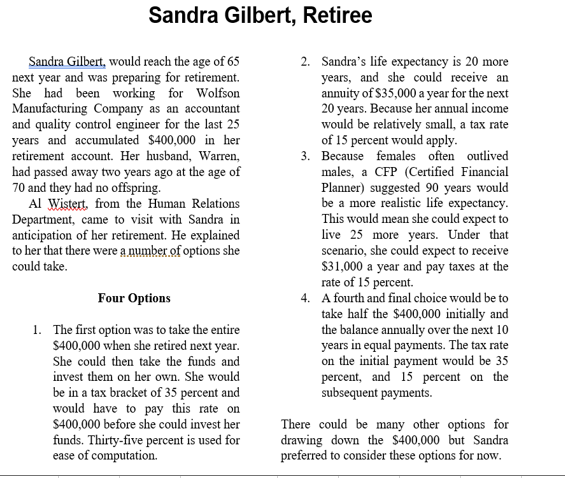

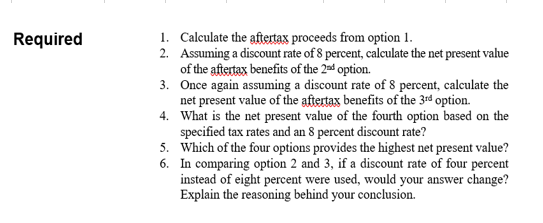

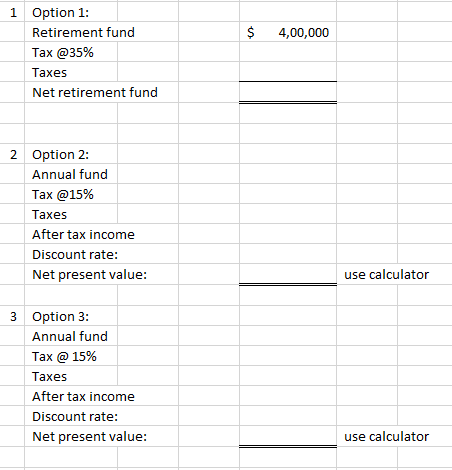

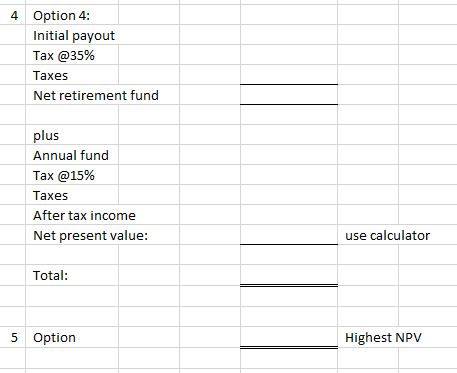

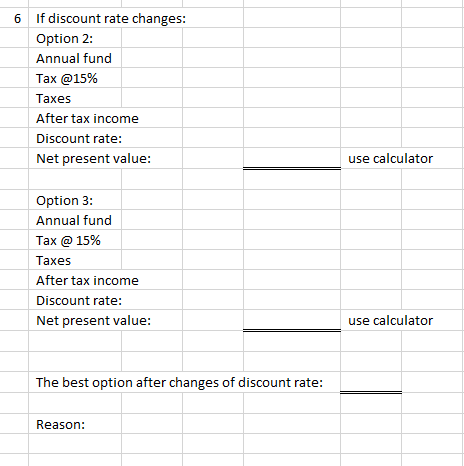

Sandra Gilbert, Retiree 1. Calculate the aftertax proceeds from option 1 . 2. Assuming a discount rate of 8 percent, calculate the net present value of the aftertax benefits of the 22d option. 3. Once again assuming a discount rate of 8 percent, calculate the net present value of the aftertax benefits of the 3rs option. 4. What is the net present value of the fourth option based on the specified tax rates and an 8 percent discount rate? 5. Which of the four options provides the highest net present value? 6. In comparing option 2 and 3 , if a discount rate of four percent instead of eight percent were used, would your answer change? Explain the reasoning behind your conclusion. 1 Option 1: \begin{tabular}{|l|} \hline Retirement fund \\ \hline Tax@35\% \\ \hline Taxes \\ \hline Net retirement fund \\ \hline \end{tabular} \begin{tabular}{l|l|l|l|l|} \hline 2 & Option 2: \\ \hline Annual fund \\ \hline Tax@15\% & & \\ \hline Taxes \\ \hline After tax income & & \\ \hline Discount rate: & & \\ \hline Net present value: & & \\ \hline & \\ \hline 3 & Option 3: & & \\ \hline & Annual fund & & \\ \hline & Tax@15\% & & \\ \hline & Taxes & & \\ \hline & After tax income & & \\ \hline & Discount rate: & & \\ \hline & Net present value: & & \\ \hline \end{tabular} 4 Option 4: Initial payout Tax@35\% Taxes Net retirement fund plus Annual fund Tax@15\% Taxes After tax income Net present value: use calculator Total: 5 Option Highest NPV 6 If discount rate changes: Option 2: Annual fund Tax@15\% Taxes After tax income Discount rate: Net present value: use calculator Option 3: Annual fund Tax@15\% Taxes After tax income Discount rate: Net present value: use calculator The best option after changes of discount rate: Reason: Sandra Gilbert, Retiree 1. Calculate the aftertax proceeds from option 1 . 2. Assuming a discount rate of 8 percent, calculate the net present value of the aftertax benefits of the 22d option. 3. Once again assuming a discount rate of 8 percent, calculate the net present value of the aftertax benefits of the 3rs option. 4. What is the net present value of the fourth option based on the specified tax rates and an 8 percent discount rate? 5. Which of the four options provides the highest net present value? 6. In comparing option 2 and 3 , if a discount rate of four percent instead of eight percent were used, would your answer change? Explain the reasoning behind your conclusion. 1 Option 1: \begin{tabular}{|l|} \hline Retirement fund \\ \hline Tax@35\% \\ \hline Taxes \\ \hline Net retirement fund \\ \hline \end{tabular} \begin{tabular}{l|l|l|l|l|} \hline 2 & Option 2: \\ \hline Annual fund \\ \hline Tax@15\% & & \\ \hline Taxes \\ \hline After tax income & & \\ \hline Discount rate: & & \\ \hline Net present value: & & \\ \hline & \\ \hline 3 & Option 3: & & \\ \hline & Annual fund & & \\ \hline & Tax@15\% & & \\ \hline & Taxes & & \\ \hline & After tax income & & \\ \hline & Discount rate: & & \\ \hline & Net present value: & & \\ \hline \end{tabular} 4 Option 4: Initial payout Tax@35\% Taxes Net retirement fund plus Annual fund Tax@15\% Taxes After tax income Net present value: use calculator Total: 5 Option Highest NPV 6 If discount rate changes: Option 2: Annual fund Tax@15\% Taxes After tax income Discount rate: Net present value: use calculator Option 3: Annual fund Tax@15\% Taxes After tax income Discount rate: Net present value: use calculator The best option after changes of discount rate: Reason

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts