Question: Please answer everything and in detail. Please answer all the columns. Purpose: The case gives the student additional opportunities to work with issues related to

Please answer everything and in detail. Please answer all the columns.

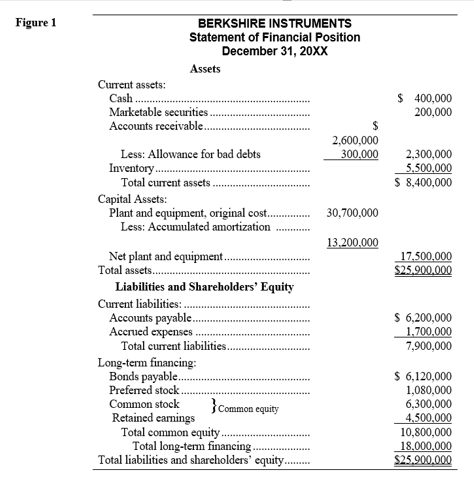

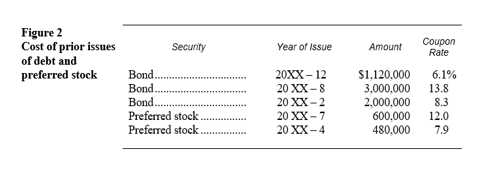

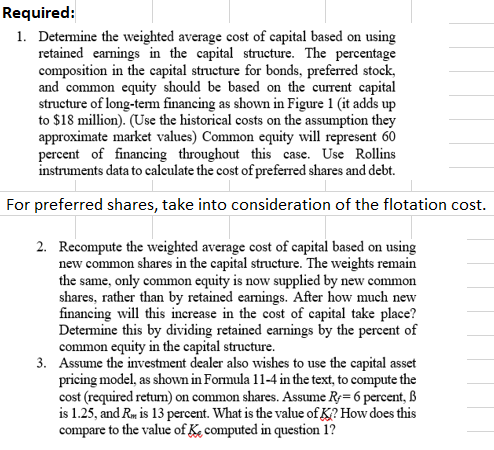

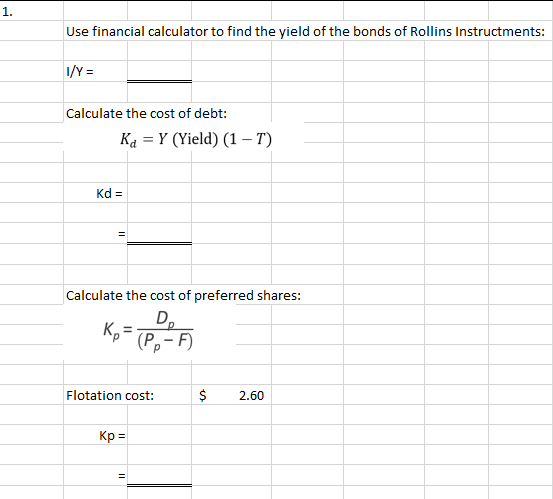

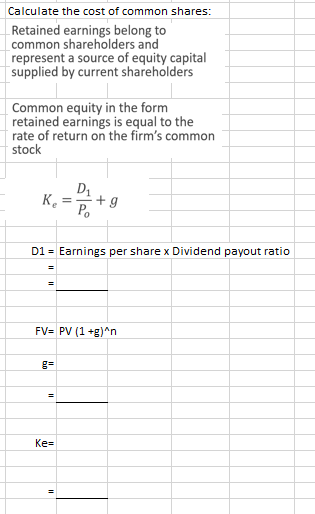

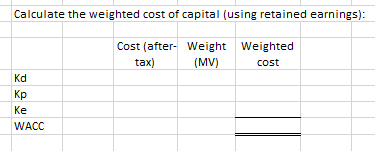

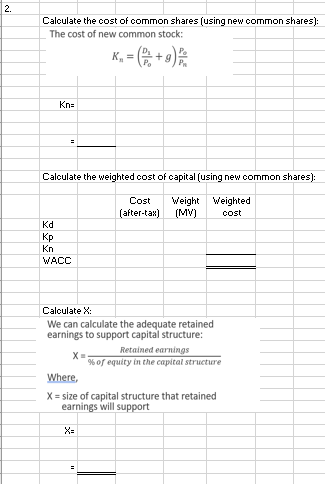

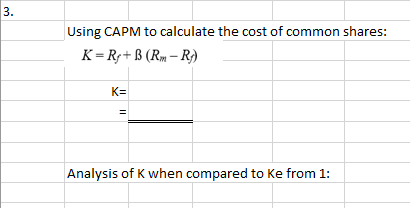

Purpose: The case gives the student additional opportunities to work with issues related to cost of capital. It focuses on the irrelevance of historical cost and the close relationship of retained earnings and new common stock in supplying equity capital. The concept of the marginal cost of capital is heavily stressed, and the use of the capital asset pricing model as an alternative to computing the cost of equity capital is also introduced. Please note that it is assumed that the historical costs of the capital structure approximate their market values. Relation to Text: The case should follow Chapter 11 . Complexity: The case tends to be reasonably straightforward and requires about 1/2 hour. Berkshire Instruments With all this information in hand, Al Hansen sat down to determine his firm's cost of capital. He was a little confused about computing the firm's cost of common equity. He knew there were two different formulas: one: one for the cost of retained earnings and one for the cost of new common stock. His investment dealer suggested that he follow the normally accepted approach used in determining the marginal cost of capital. First, determine the cost of capital for as large a capital structure as current retained earnings will support; then, determine the cost of capital based on exclusively using new common stock. Figure 1 Figure 2 1. Determine the weighted average cost of capital based on using retained earnings in the capital structure. The percentage composition in the capital structure for bonds, preferred stock, and common equity should be based on the current capital structure of long-term financing as shown in Figure 1 (it adds up to $18 million). (Use the historical costs on the assumption they approximate market values) Common equity will represent 60 percent of financing throughout this case. Use Rollins instruments data to calculate the cost of preferred shares and debt. -or preferred shares, take into consideration of the flotati 2. Recompute the weighted average cost of capital based on using new common shares in the capital structure. The weights remain the same, only common equity is now supplied by new common shares, rather than by retained earnings. After how much new financing will this increase in the cost of capital take place? Determine this by dividing retained earnings by the percent of common equity in the capital structure. 3. Assume the investment dealer also wishes to use the capital asset pricing model, as shown in Formula 11-4 in the text, to compute the cost (required return) on common shares. Assume Rf=6 percent, B is 1.25, and Rm is 13 percent. What is the value of K ? How does this compare to the value of Ke computed in question 1 ? Use financial calculator to find the yield of the bonds of Rollins Instructments: I/Y= Calculate the cost of debt: Kd=Y(Yield)(1T) Kd= Calculate the cost of preferred shares: Kp=(PpF)Dp Flotation cost: $2.60 Kp= Calculate the cost of common shares: Retained earnings belong to common shareholders and represent a source of equity capital supplied by current shareholders Common equity in the form retained earnings is equal to the rate of return on the firm's common stock Ke=PoD1+g D1 = Earnings per share x Dividend payout ratio = = FV=PV(1+g)n g= Ke= Calculate the weighted cost of capital (using retained earnings): Calculate the cost of common shares (using new common shares): The cost of new common stock: Kn=(P0D1+g)PnPo 3. Using CAPM to calculate the cost of common shares: K=RfK==+(RmRf) Analysis of K when compared to Ke from 1 : Purpose: The case gives the student additional opportunities to work with issues related to cost of capital. It focuses on the irrelevance of historical cost and the close relationship of retained earnings and new common stock in supplying equity capital. The concept of the marginal cost of capital is heavily stressed, and the use of the capital asset pricing model as an alternative to computing the cost of equity capital is also introduced. Please note that it is assumed that the historical costs of the capital structure approximate their market values. Relation to Text: The case should follow Chapter 11 . Complexity: The case tends to be reasonably straightforward and requires about 1/2 hour. Berkshire Instruments With all this information in hand, Al Hansen sat down to determine his firm's cost of capital. He was a little confused about computing the firm's cost of common equity. He knew there were two different formulas: one: one for the cost of retained earnings and one for the cost of new common stock. His investment dealer suggested that he follow the normally accepted approach used in determining the marginal cost of capital. First, determine the cost of capital for as large a capital structure as current retained earnings will support; then, determine the cost of capital based on exclusively using new common stock. Figure 1 Figure 2 1. Determine the weighted average cost of capital based on using retained earnings in the capital structure. The percentage composition in the capital structure for bonds, preferred stock, and common equity should be based on the current capital structure of long-term financing as shown in Figure 1 (it adds up to $18 million). (Use the historical costs on the assumption they approximate market values) Common equity will represent 60 percent of financing throughout this case. Use Rollins instruments data to calculate the cost of preferred shares and debt. -or preferred shares, take into consideration of the flotati 2. Recompute the weighted average cost of capital based on using new common shares in the capital structure. The weights remain the same, only common equity is now supplied by new common shares, rather than by retained earnings. After how much new financing will this increase in the cost of capital take place? Determine this by dividing retained earnings by the percent of common equity in the capital structure. 3. Assume the investment dealer also wishes to use the capital asset pricing model, as shown in Formula 11-4 in the text, to compute the cost (required return) on common shares. Assume Rf=6 percent, B is 1.25, and Rm is 13 percent. What is the value of K ? How does this compare to the value of Ke computed in question 1 ? Use financial calculator to find the yield of the bonds of Rollins Instructments: I/Y= Calculate the cost of debt: Kd=Y(Yield)(1T) Kd= Calculate the cost of preferred shares: Kp=(PpF)Dp Flotation cost: $2.60 Kp= Calculate the cost of common shares: Retained earnings belong to common shareholders and represent a source of equity capital supplied by current shareholders Common equity in the form retained earnings is equal to the rate of return on the firm's common stock Ke=PoD1+g D1 = Earnings per share x Dividend payout ratio = = FV=PV(1+g)n g= Ke= Calculate the weighted cost of capital (using retained earnings): Calculate the cost of common shares (using new common shares): The cost of new common stock: Kn=(P0D1+g)PnPo 3. Using CAPM to calculate the cost of common shares: K=RfK==+(RmRf) Analysis of K when compared to Ke from 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts