Question: Please answer EVERYTHING CORRECTLY. READ the question CAREFULLY. Any wrong answers will be DOWNVOTED. Thank you! On September 30,2022 , the company sold old equipment

Please answer EVERYTHING CORRECTLY. READ the question CAREFULLY. Any wrong answers will be DOWNVOTED. Thank you!

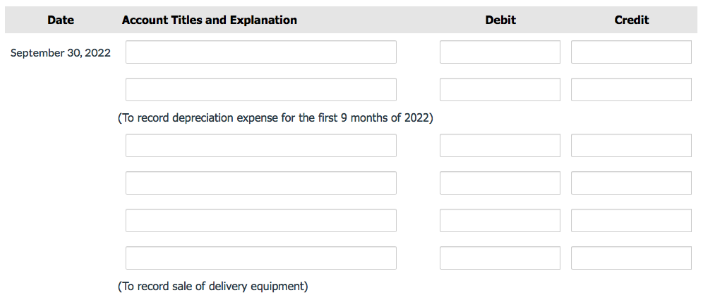

On September 30,2022 , the company sold old equipment for $105,800. The equipment was purchased on January 1,2020 , for $220,800 and was estimated to have a $36,800 salvage value at the end of its 5-year life. Depreciation on the equipment has been recorded through December 31, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) \begin{tabular}{c|c|} \hline Date & Account Titles and Explanation \\ September 30,2022 & \\ \hline \end{tabular} Debit Credit (To record depreciation expense for the first 9 months of 2022) (To record sale of delivery equipment)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts