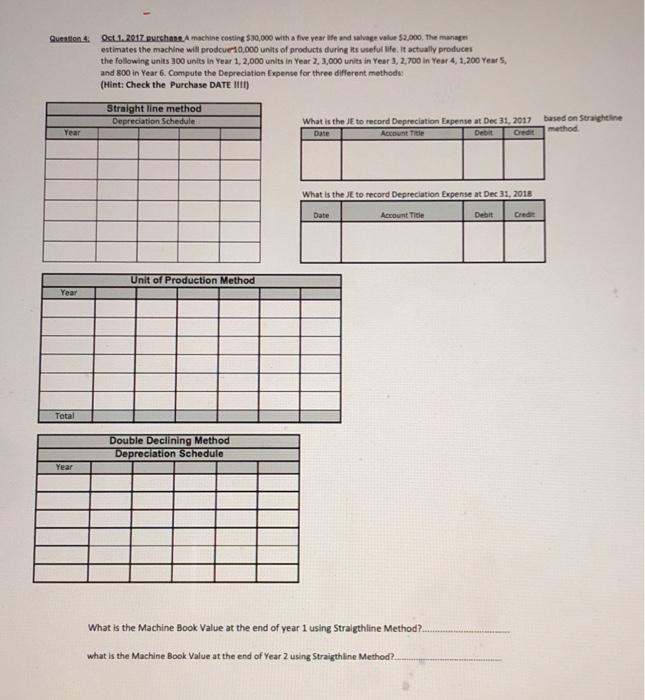

Question: please answer everything correctly with the charts as well Oct. 1. 2017 purchase A machine costing $30,000 with a five year life and salvage value

Oct. 1. 2017 purchase A machine costing $30,000 with a five year life and salvage value $2,000. The manage estimates the machine will produer 10,000 units of products during its useful life. It actually produces the following units 100 units in Year 1, 2,000 units in Year 2, 3,000 units in Year 3, 2,700 in Year 4, 1,200 Years. and 800 in Year 6. Compute the Depreciation Expense for three different methods (Hint: Check the Purchase DATE MIT) Straight line method Depreciation Schedule What is the Je to record Depreciation Expense at Dec 31, 2017 Date Account Title Credit based on straight line method Year What is the JEto record Depreciation Expense at Dec 31, 2018 Date Account Tide Debit Credit Unit of Production Method Year Total Double Declining Method Depreciation Schedule Year What is the Machine Book Value at the end of year I using Straigthline Method? what is the Machine Book Value at the end of Year 2 using Straigthline Method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts