Question: please answer fast i will thumbs up View Policies Current Attempt in Progress - /1.5 At December 31, 2020, the end of its first year

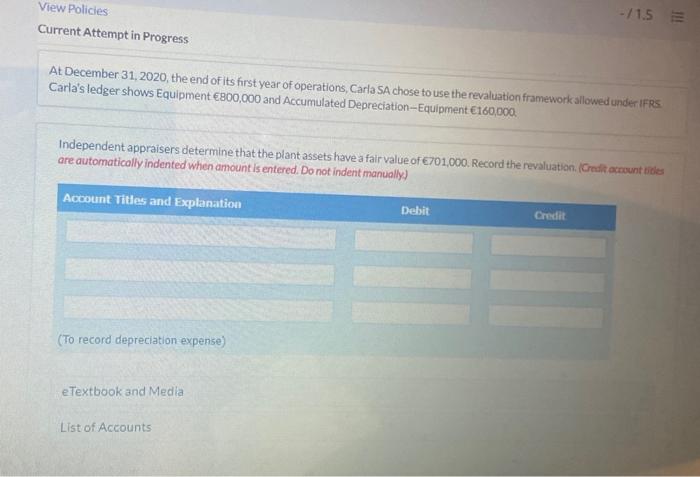

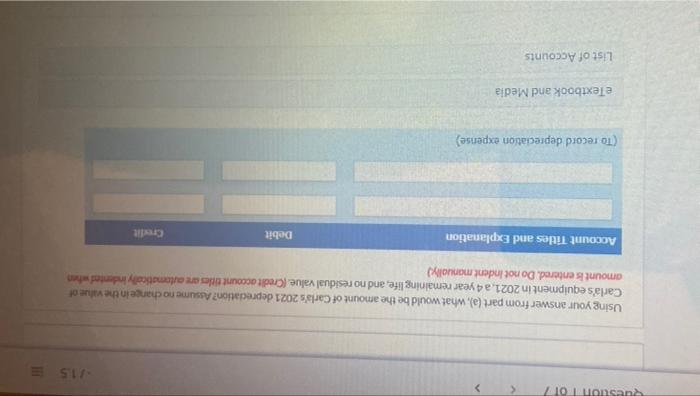

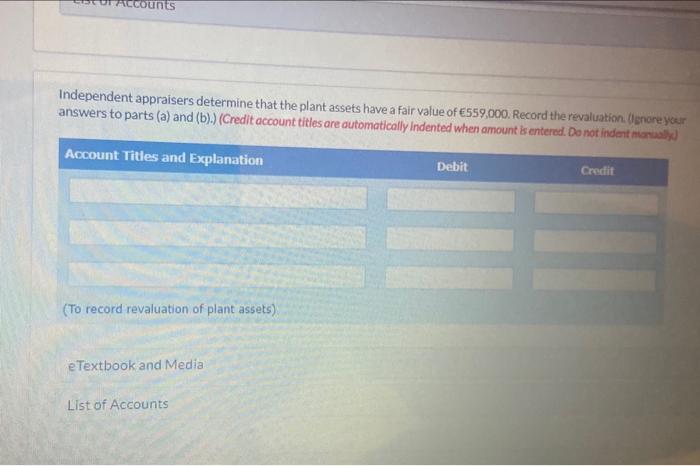

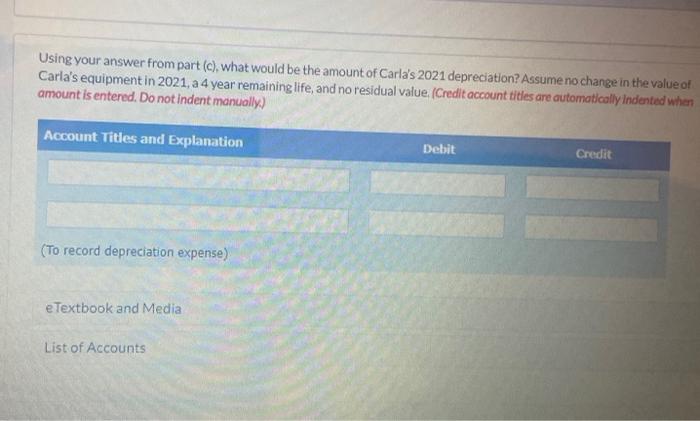

View Policies Current Attempt in Progress - /1.5 At December 31, 2020, the end of its first year of operations, Carla SA chose to use the revaluation framework allowed under IFRS Carla's ledger shows Equipment 800,000 and Accumulated Depreciation-Equipment 160,000 Independent appraisers determine that the plant assets have a fair value of 701,000. Record the revaluation. (Credit account des are automatically indented when amount is entered. Do not indent manually) Account Titles and Explanation Debit Credit (To record depreciation expense) e Textbook and Media List of Accounts Question 1017 71.5 Using your answer from part (), what would be the amount of Carla's 2021 depreciation? Assume no change in the value of Carla's equipment in 2021, a 4 year remaining life, and no residual value. (Credit account titles are avtomatically indented when amount is entered. Do not indent manually) Account Titles and Explanation Debit Credit (To record depreciation expense) e Textbook and Media List of Accounts Accounts Independent appraisers determine that the plant assets have a fair value of 559,000. Record the revaluation. Ognore your answers to parts (a) and (b).) (Credit account titles are automatically Indented when amount is entered. Do not indent mortaly) Account Titles and Explanation Debit Credit (To record revaluation of plant assets) e Textbook and Media List of Accounts Using your answer from part (c), what would be the amount of Carla's 2021 depreciation? Assume no change in the value of Carla's equipment in 2021, a 4 year remaining life, and no residual value. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit (To record depreciation expense) e Textbook and Media List of Accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts