Question: please answer fast please answer fast 2 mins leftttt Derek can deposit $11,000 on euch birthday beginning with his 26th and ending with his 65th.

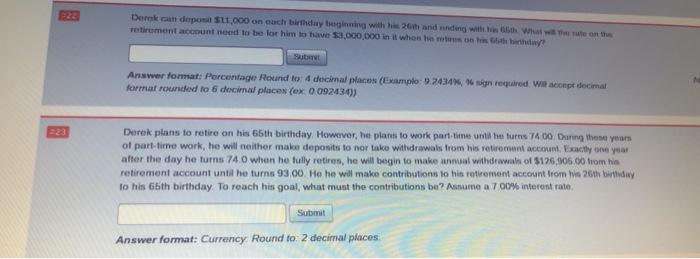

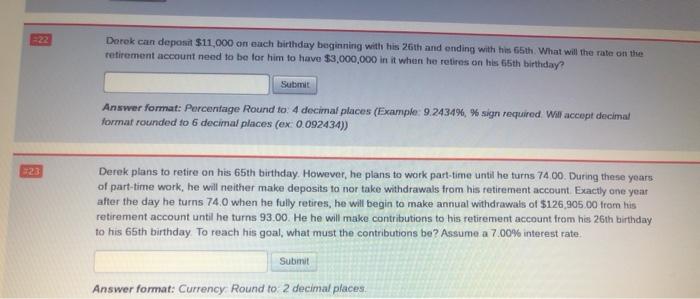

Derek can deposit $11,000 on euch birthday beginning with his 26th and ending with his 65th. What will the rate on the retirement account need to be for him to have $3,000,000 in it when he retires on his 65th birthday Submit Answer format: Percentage Round to 4 decimal places (Example: 9.2434%, % sign required Will accept decimal format rounded to 6 decimal places (ex 0.092434)) Derek plans to retire on his 65th birthday. However, he plans to work part-time until he turns 74.00. During these years of part-time work, he will neither make deposits to nor take withdrawals from his retirement account Exactly one year after the day he turns 74.0 when he fully retires, he will begin to make annual withdrawals of $126,905 00 from his retirement account until he turns 93.00. He he will make contributions to his retirement account from his 26th birthday to his 65th birthday. To reach his goal, what must the contributions be? Assume a 7.00% interest rate Submit Answer format: Currency Round to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts