Question: Please answer for both the arbitrage strategy for a two-year forward price of $60, as well as $65. The spot price of an investment asset

Please answer for both the arbitrage strategy for a two-year forward price of $60, as well as $65.

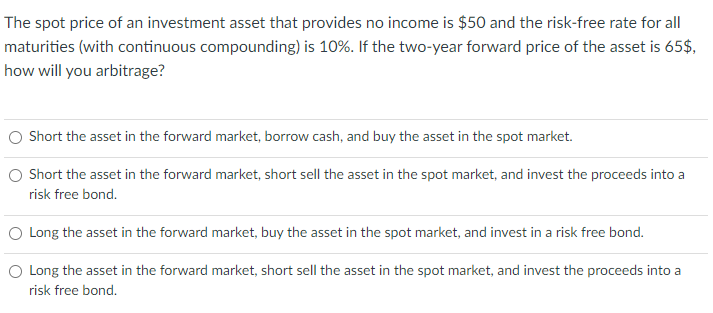

The spot price of an investment asset that provides no income is $50 and the risk-free rate for all maturities (with continuous compounding) is 10%. If the two-year forward price of the asset is 65$, how will you arbitrage? Short the asset in the forward market, borrow cash, and buy the asset in the spot market. Short the asset in the forward market, short sell the asset in the spot market, and invest the proceeds into a risk free bond. Long the asset in the forward market, buy the asset in the spot market, and invest in a risk free bond. Long the asset in the forward market, short sell the asset in the spot market, and invest the proceeds into a risk free bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts