Question: Please answer for the empty yellow spaces using the below information. And if possible, please clarify which numbers go to which allotted spaces. The Lancaster

Please answer for the empty yellow spaces using the below information. And if possible, please clarify which numbers go to which allotted spaces.

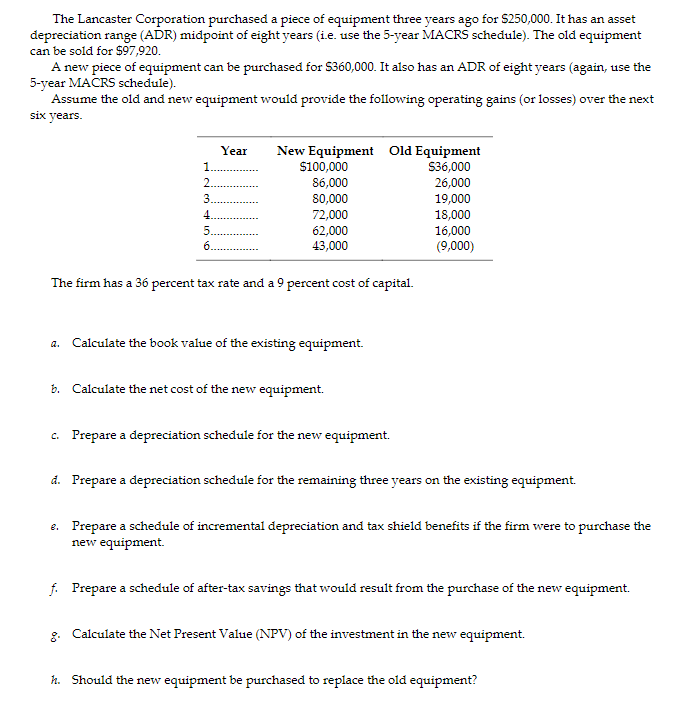

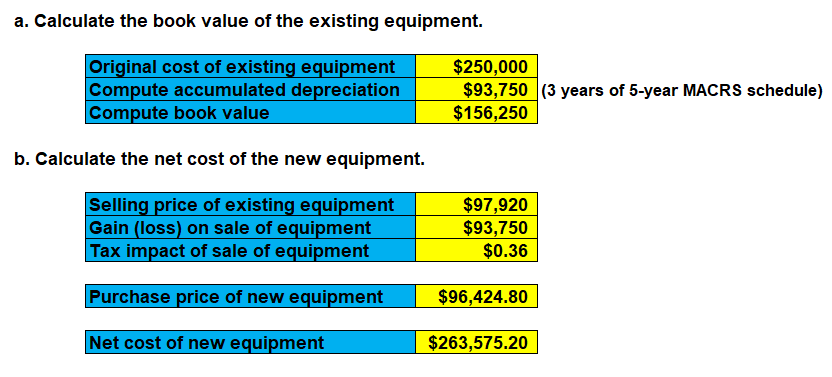

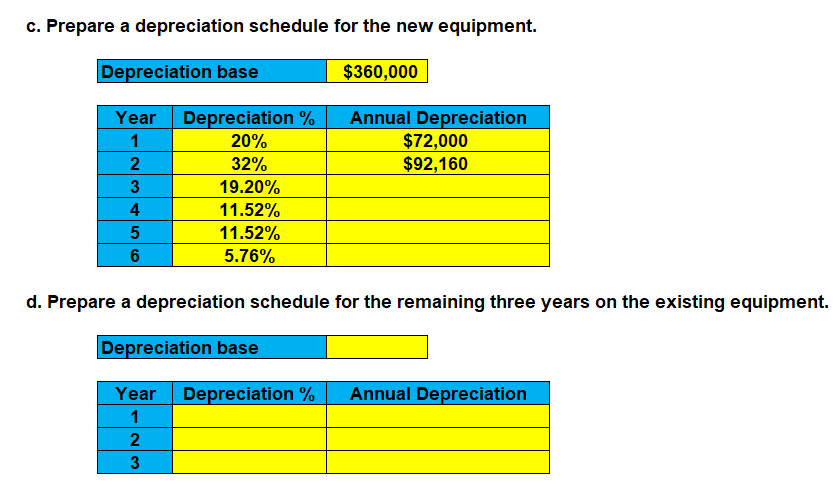

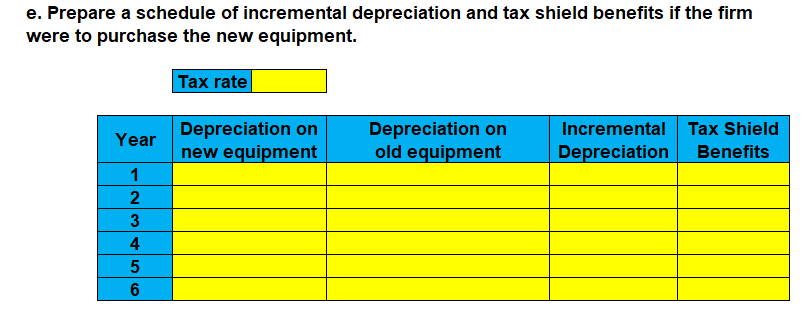

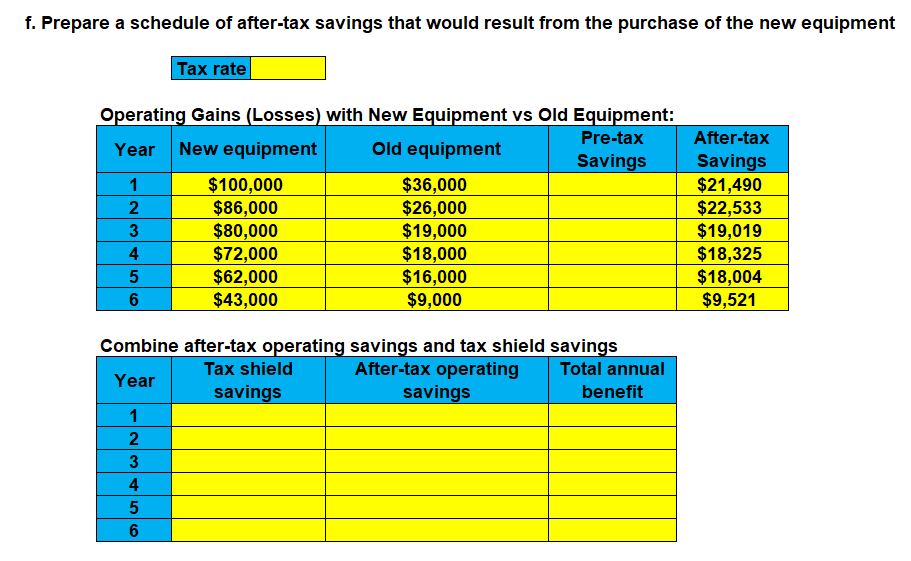

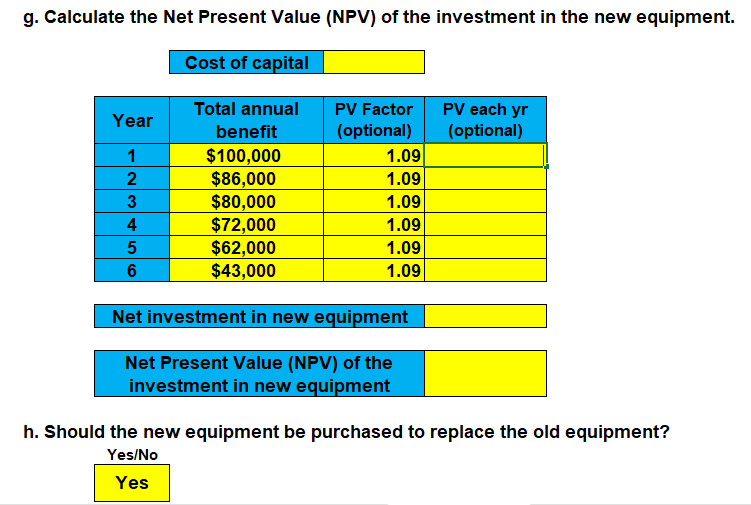

The Lancaster Corporation purchased a piece of equipment three years ago for $250,000. It has an asset depreciation range (ADR) midpoint of eight years (i.e. use the 5-year MACRS schedule). The old equipment can be sold for $97,920. A new piece of equipment can be purchased for $360,000. It also has an ADR of eight years (again, use the 5 -year MACRS schedule). Assume the old and new equipment would provide the following operating gains (or losses) over the next six years. The firm has a 36 percent tax rate and a 9 percent cost of capital. a. Calculate the book value of the existing equipment. b. Calculate the net cost of the new equipment. c. Prepare a depreciation schedule for the new equipment. d. Prepare a depreciation schedule for the remaining three years on the existing equipment. e. Prepare a schedule of incremental depreciation and tax shield benefits if the firm were to purchase the new equipment. f. Prepare a schedule of after-tax savings that would result from the purchase of the new equipment. g. Calculate the Net Present Value (NPV) of the investment in the new equipment. h. Should the new equipment be purchased to replace the old equipment? a. Calculate the book value of the existing equipment. ( 3 years of 5-year MACRS schedule) b. Calculate the net cost of the new equipment. c. Prepare a depreciation schedule for the new equipment. d. Prepare a depreciation schedule for the remaining three years on the existing equipment. e. Prepare a schedule of incremental depreciation and tax shield benefits if the firm were to purchase the new equipment. Prepare a schedule of after-tax savings that would result from the purchase of the new equipment Operating Gains (Losses) with New Equipment vs Old Equipment: Combine after-tax operating savings and tax shield savings g. Calculate the Net Present Value (NPV) of the investment in the new equipment. h. Should the new equipment be purchased to replace the old equipment? Yes/No The Lancaster Corporation purchased a piece of equipment three years ago for $250,000. It has an asset depreciation range (ADR) midpoint of eight years (i.e. use the 5-year MACRS schedule). The old equipment can be sold for $97,920. A new piece of equipment can be purchased for $360,000. It also has an ADR of eight years (again, use the 5 -year MACRS schedule). Assume the old and new equipment would provide the following operating gains (or losses) over the next six years. The firm has a 36 percent tax rate and a 9 percent cost of capital. a. Calculate the book value of the existing equipment. b. Calculate the net cost of the new equipment. c. Prepare a depreciation schedule for the new equipment. d. Prepare a depreciation schedule for the remaining three years on the existing equipment. e. Prepare a schedule of incremental depreciation and tax shield benefits if the firm were to purchase the new equipment. f. Prepare a schedule of after-tax savings that would result from the purchase of the new equipment. g. Calculate the Net Present Value (NPV) of the investment in the new equipment. h. Should the new equipment be purchased to replace the old equipment? a. Calculate the book value of the existing equipment. ( 3 years of 5-year MACRS schedule) b. Calculate the net cost of the new equipment. c. Prepare a depreciation schedule for the new equipment. d. Prepare a depreciation schedule for the remaining three years on the existing equipment. e. Prepare a schedule of incremental depreciation and tax shield benefits if the firm were to purchase the new equipment. Prepare a schedule of after-tax savings that would result from the purchase of the new equipment Operating Gains (Losses) with New Equipment vs Old Equipment: Combine after-tax operating savings and tax shield savings g. Calculate the Net Present Value (NPV) of the investment in the new equipment. h. Should the new equipment be purchased to replace the old equipment? Yes/No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts