Question: please answer. how to input the closing stock figure and how to process relevant journal entey in detail. Record Journal Entry Display in GST [BAS]

![relevant journal entey in detail. Record Journal Entry Display in GST [BAS]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f1e6a86df3f_25666f1e6a803717.jpg)

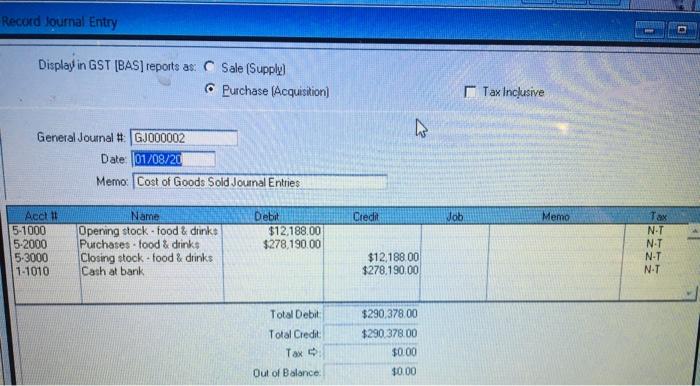

Record Journal Entry Display in GST [BAS] reports as: C Sale (Supply) General Journal # GJ000002 Date: 01/08/20 Memo: Cost of Goods Sold Journal Entries Acct #1 Debit Name Opening stock food & drinks $12,188.00 $278,190.00 Purchases food & drinks Closing stock food & drinks Cash at bank Total Debit Total Credit Tax : Out of Balance: 5-1000 5-2000 5-3000 1-1010 Purchase (Acquisition) Credit 4 $12,188.00 $278,190.00 $290,378.00 $290,378.00 $0.00 $0.00 Job Tax Inclusive Memo Tax N-T N-T N-T N-T A The bookkeeper, a, did not know how to input the closing stock figure of $18,402 into the MYOB management accounts and specifically asks you to process the relevant journal entry/entries directly into MYOB on her behalf. You note from perusing the MYOB data file that she has left the opening stock figure of $12,188 (which she entered on 1 August 2020) in the MYOB management accounts as She did not know how to do the adjustment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts