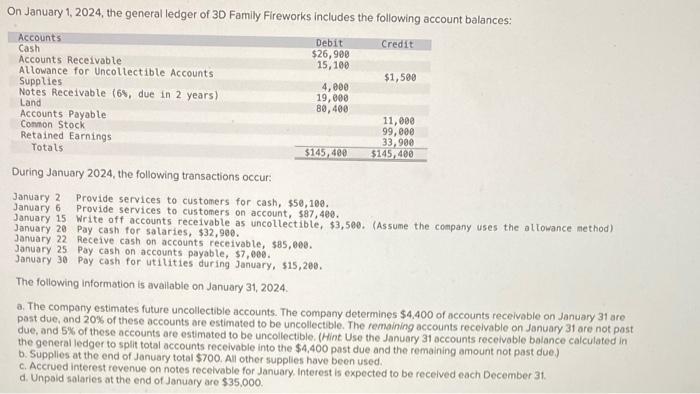

Question: please answer i need the journal entry On January 1, 2024, the general ledger of 3D Family Fireworks includes the following account balances: During January

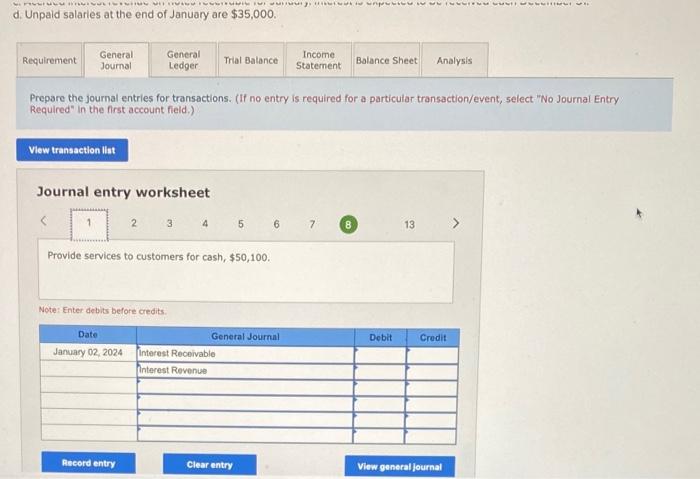

On January 1, 2024, the general ledger of 3D Family Fireworks includes the following account balances: During January 2024, the following transactions occur: January 2 Provide services to customers for cash, $50,100. January 6 Provide services to customers on account, $87,409, January 15 Write off accounts receivable as uncollectible, $3,500. (Assume the company uses the altowance nethod) January 20 Pay cash for sataries, $32,900. January 22 Receive cash on accounts receivable, 585,000. January 25 Pay cash on accounts payable, \$7,000. January 30 Pay cash for utilities during January, 515,208 . The following information is available on January 31, 2024. a. The company estimates future uncollectible accounts. The company determines $4.400 of accounts recelvable on January 31 are past due, and 20% of these accounts are estimated to be uncollectble. The remaining accounts recelvable on January 31 are not post due, and 5% of these accounts are estimated to be uncollectible. (Hint. Use the January 31 accounts recelvable baiance calculated in the general ledger to split total accounts receivable into the $4,400 past due and the remaining amount not past due.) b. Supplies at the end of January total $700. All other supplies have been used. c. Accrued interest revenue on notes recelvable for January. Interest is expected to be recelved each December 31 . d. Unpoid salaries at the end of January are $35.000. d. Unpaid salaries at the end of January are $35,000. Prepare the journal entries for transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts