Question: Please answer if true or false: 6. Current income tax law allows a deduction for IRC 212 expenditures associated with rent or royalty income as

Please answer if true or false:

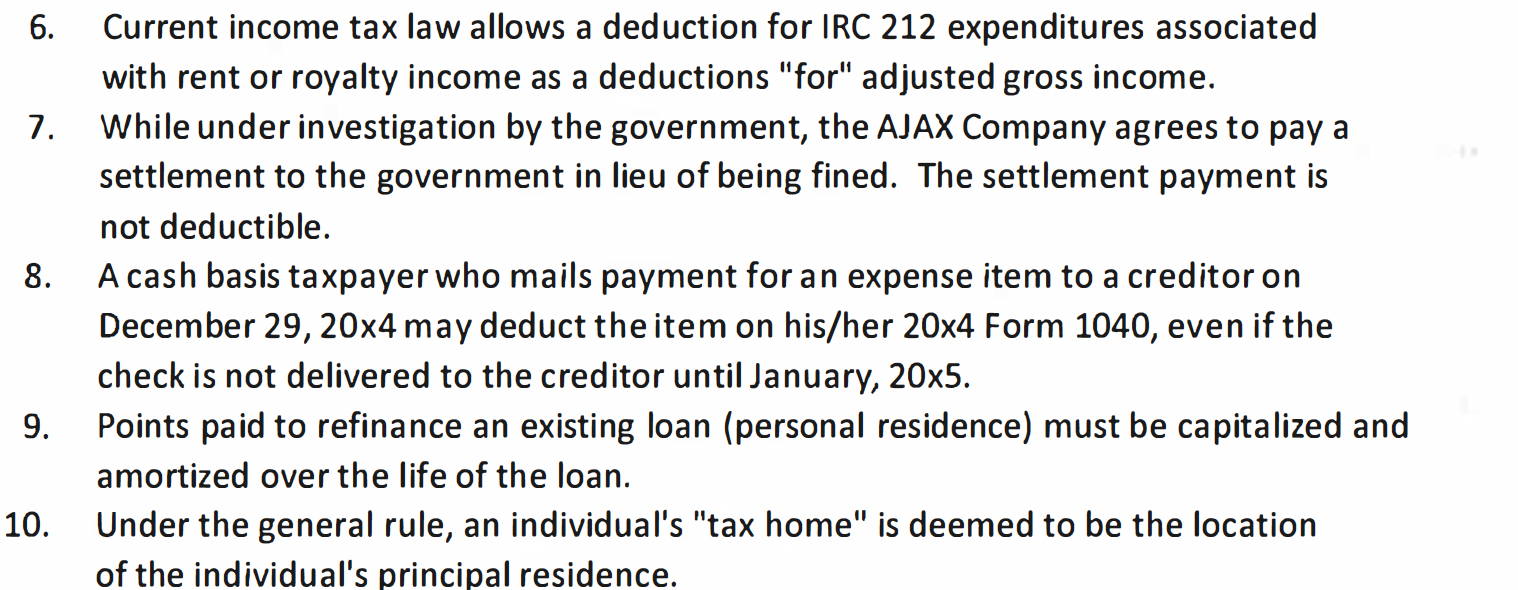

6. Current income tax law allows a deduction for IRC 212 expenditures associated with rent or royalty income as a deductions "for" adjusted gross income. 7. While under investigation by the government, the AJAX Company agrees to pay a settlement to the government in lieu of being fined. The settlement payment is not deductible. 8. A cash basis taxpayer who mails payment for an expense item to a creditor on December 29,204 may deduct the item on his/her 204 Form 1040, even if the check is not delivered to the creditor until January, 205. 9. Points paid to refinance an existing loan (personal residence) must be capitalized an amortized over the life of the loan. 10. Under the general rule, an individual's "tax home" is deemed to be the location of the individual's principal residence. 6. Current income tax law allows a deduction for IRC 212 expenditures associated with rent or royalty income as a deductions "for" adjusted gross income. 7. While under investigation by the government, the AJAX Company agrees to pay a settlement to the government in lieu of being fined. The settlement payment is not deductible. 8. A cash basis taxpayer who mails payment for an expense item to a creditor on December 29,204 may deduct the item on his/her 204 Form 1040, even if the check is not delivered to the creditor until January, 205. 9. Points paid to refinance an existing loan (personal residence) must be capitalized an amortized over the life of the loan. 10. Under the general rule, an individual's "tax home" is deemed to be the location of the individual's principal residence

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts