Question: Question Number One Twenty true - false statements appear below. You must answer all of them. For each statement, insert T or

Question Number One

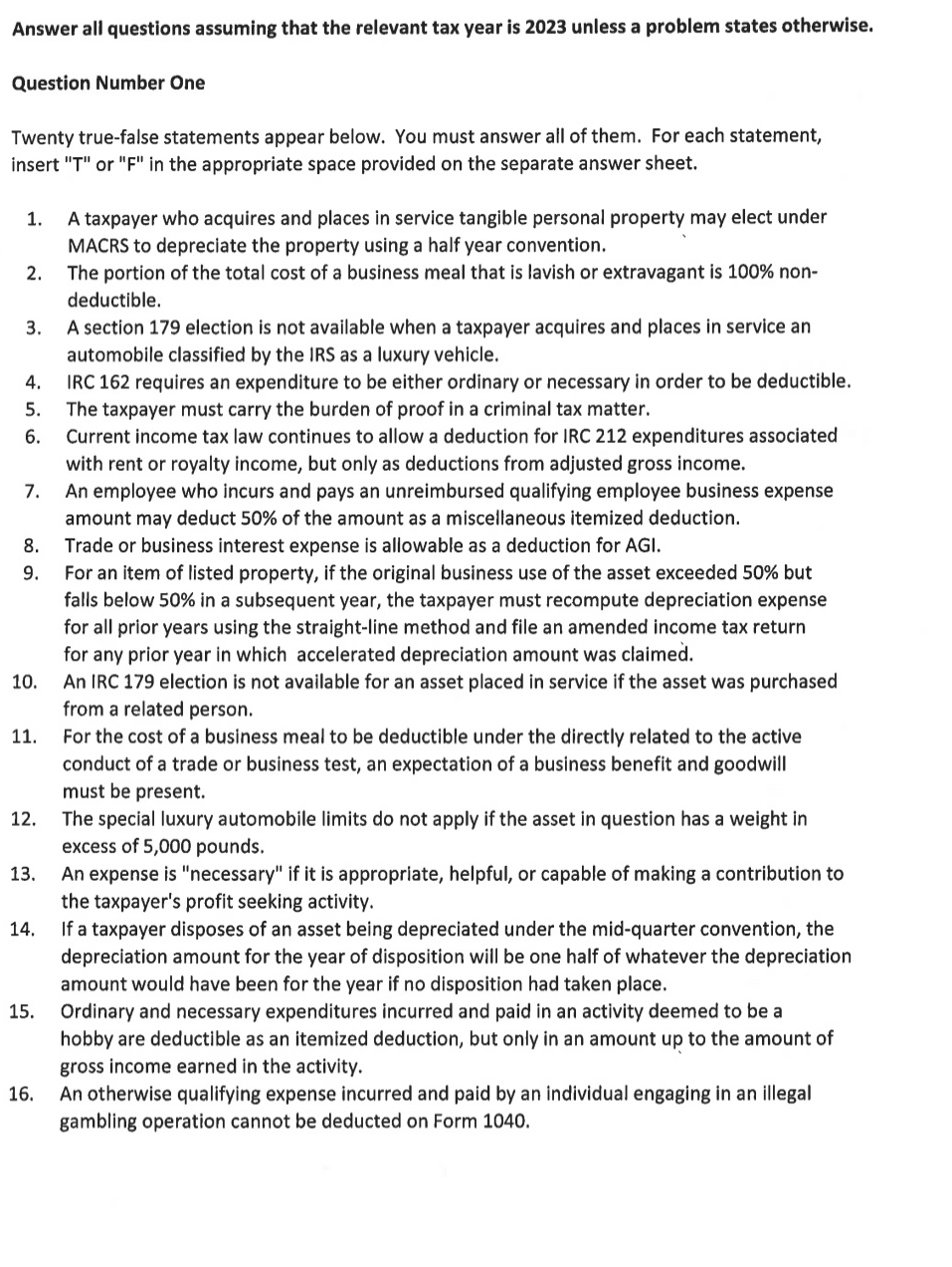

Twenty truefalse statements appear below. You must answer all of them. For each statement, insert T or F in the appropriate space provided on the separate answer sheet.

Answer all questions assuming that the relevant tax year is unless a problem states otherwise.

Question Number One

Twenty truefalse statements appear below. You must answer all of them. For each statement,

insert T or F in the appropriate space provided on the separate answer sheet.

A taxpayer who acquires and places in service tangible personal property may elect under

MACRS to depreciate the property using a half year convention.

The portion of the total cost of a business meal that is lavish or extravagant is non

deductible.

A section election is not available when a taxpayer acquires and places in service an

automobile classified by the IRS as a luxury vehicle.

IRC requires an expenditure to be either ordinary or necessary in order to be deductible.

The taxpayer must carry the burden of proof in a criminal tax matter.

Current income tax law continues to allow a deduction for IRC expenditures associated

with rent or royalty income, but only as deductions from adjusted gross income.

An employee who incurs and pays an unreimbursed qualifying employee business expense

amount may deduct of the amount as a miscellaneous itemized deduction.

Trade or business interest expense is allowable as a deduction for AGI.

For an item of listed property, if the original business use of the asset exceeded but

falls below in a subsequent year, the taxpayer must recompute depreciation expense

for all prior years using the straightline method and file an amended income tax return

for any prior year in which accelerated depreciation amount was claimed.

An IRC election is not available for an asset placed in service if the asset was purchased

from a related person.

For the cost of a business meal to be deductible under the directly related to the active

conduct of a trade or business test, an expectation of a business benefit and goodwill

must be present.

The special luxury automobile limits do not apply if the asset in question has a weight in

excess of pounds.

An expense is "necessary" if it is appropriate, helpful, or capable of making a contribution to

the taxpayer's profit seeking activity.

If a taxpayer disposes of an asset being depreciated under the midquarter convention, the

depreciation amount for the year of disposition will be one half of whatever the depreciation

amount would have been for the year if no disposition had taken place.

Ordinary and necessary expenditures incurred and paid in an activity deemed to be a

hobby are deductible as an itemized deduction, but only in an amount up to the amount of

gross income earned in the activity.

An otherwise qualifying expense incurred and paid by an individual engaging in an illegal

gambling operation cannot be deducted on Form

A selfemployed individual may deduct qualifying travel expenses incurred in hisher

trade or business activity as a deduction "for adjusted gross income."

Taxpayers filing a joint Form may not claim a deduction for student loan interest expense.

To be "ordinary" under IRC an expense should be must be habitual or recurring.

Under IRC the "all events test" is satisfied as soon as all events establishing the

existence of a liability have occurred.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock