Question: please answer if you know correct answer The Gilbert Instrument Corporation is considering replacing the wood steamer it currently uses to shape guitar sides. The

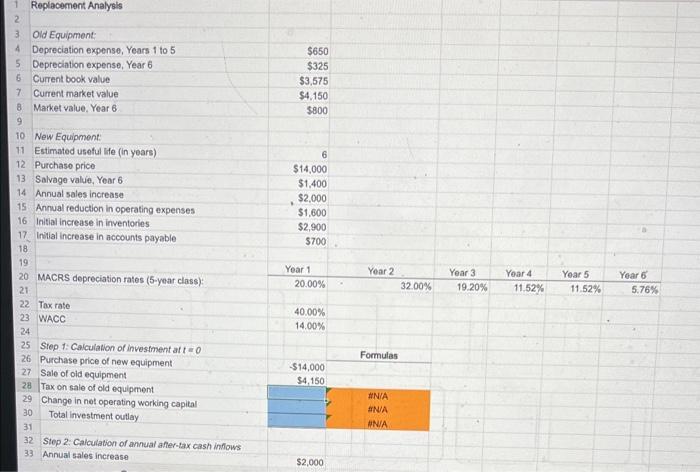

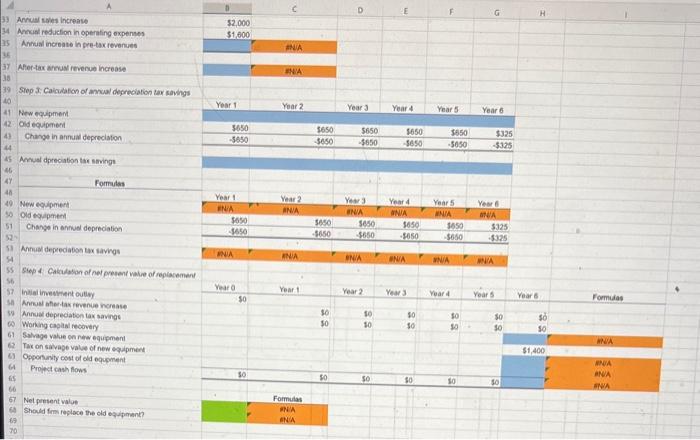

The Gilbert Instrument Corporation is considering replacing the wood steamer it currently uses to shape guitar sides. The steamer has 6 years of remaining Iife. If kept, the steamer will have depreciation expenses of $650 for 5 years and $325 for the sixth year. Its current book value is $3,575, and it can be sold on an Internet auction site for $4,150 at this time. If the old steamer is not replaced, it can be sold for $800 at the end of its useful life. Gilbert is consldering purchasing the Side Steamer 3000 , a higher-end steamer, which costs $14,000, and has an estimated useful life of 6 years with an estimated salvage value of $1,400. This steamer falls into the MACRS 5 -years class, so the applicable depreciation rates are 20.00%,32.00%,19.20%, 11.52%,11.52%, and 5.76%. The new steamer is faster and would allow for an output expansion, so sales would rise by $2,000 per year; even so, the new machine's much greater efficiency would reduce operating expenses by $1,600 per year. To support the greater sales, the new machine would require that inventories increase by $2,900, but accounts payable would simultaneously increase by $700. Gilbert's marginal federal-plus-state tax rate is 40%, and its WACC is 14%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. 1 Replacement Analygls

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts