Question: please answer in 25 min To increase the equity portion of your portfolio, you are analyzing the stock of firm YYY, Inc. The firm has

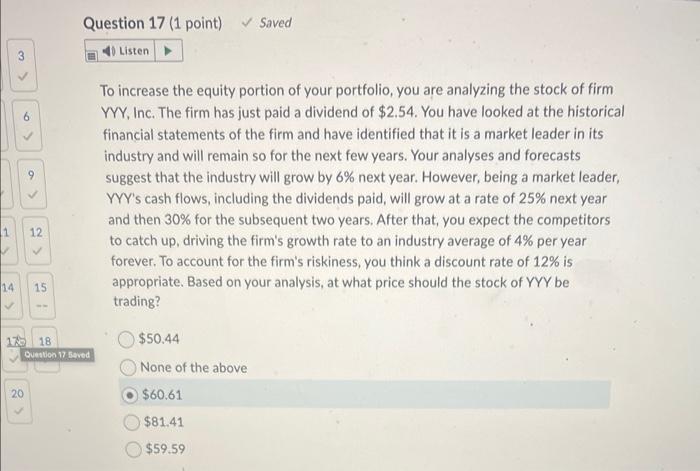

To increase the equity portion of your portfolio, you are analyzing the stock of firm YYY, Inc. The firm has just paid a dividend of $2.54. You have looked at the historical financial statements of the firm and have identified that it is a market leader in its industry and will remain so for the next few years. Your analyses and forecasts suggest that the industry will grow by 6% next year. However, being a market leader, YYY's cash flows, including the dividends paid, will grow at a rate of 25% next year and then 30% for the subsequent two years. After that, you expect the competitors to catch up, driving the firm's growth rate to an industry average of 4% per year forever. To account for the firm's riskiness, you think a discount rate of 12% is appropriate. Based on your analysis, at what price should the stock of YYY be trading? $50.44 None of the above $60.61 $81.41 $59.59

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts