Question: PLEASE ANSWER IN A NEAD FORMAT ESPECIALLY PART C & D. WILL GIVE UPVOTE AND GOOD REVIEW. THANKS :D West Indian Tobacco Company Limited Income

PLEASE ANSWER IN A NEAD FORMAT ESPECIALLY PART C & D. WILL GIVE UPVOTE AND GOOD REVIEW. THANKS :D

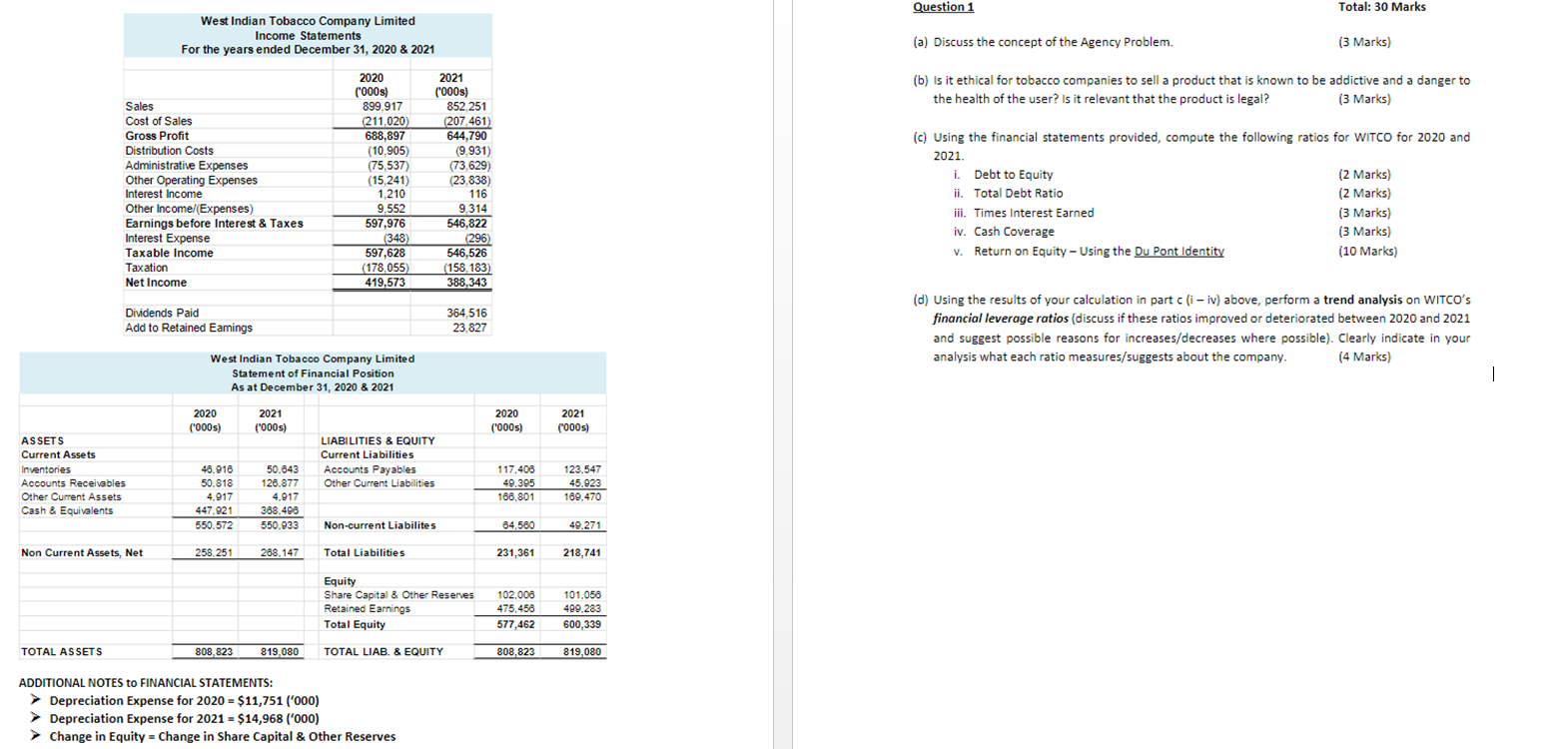

West Indian Tobacco Company Limited Income Statements For the years ended December 31, 2020 & 2021 2020 ('000s) 899,917 Sales Cost of Sales Gross Profit Distribution Costs Administrative Expenses Other Operating Expenses Interest Income Other Income/(Expenses) Earnings before Interest & Taxes Interest Expense Taxable Income Taxation Net Income Dividends Paid Add to Retained Eamings (211,020) 688,897 (10,905) (75,537) (15,241) 1,210 9,552 597,976 (348) 597,628 (178,055) 419,573 West Indian Tobacco Company Limited Statement of Financial Position As at December 31, 2020 & 2021 2021 ('000s) 2020 ('000s) 2021 ('000s) ASSETS Current Assets Inventories 48.916 50,643 126.877 Accounts Receivables 50.818 Other Current Assets 4,917 4,917 Cash & Equivalents 447,921 388,496 550,572 550,933 Non Current Assets, Net 258,251 268,147 TOTAL ASSETS 808,823 819,080 ADDITIONAL NOTES to FINANCIAL STATEMENTS: Depreciation Expense for 2020 = $11,751 ('000) Depreciation Expense for 2021 = $14,968 ('000) Change in Equity = Change in Share Capital & Other Reserves 852,251 (207,461) 644,790 (9,931) (73,629) (23,838) 116 9,314 546,822 (296) 546,526 (158,183) 388,343 364,516 23.827 LIABILITIES & EQUITY Current Liabilities Accounts Payables Other Current Liabilities Non-current Liabilites Total Liabilities Equity Share Capital & Other Reserves Retained Earnings Total Equity TOTAL LIAB. & EQUITY 2020 ('000s) 117,406 49.395 166,801 64,560 231,361 102,008 475,456 577,462 808,823 2021 ('000s) 123,547 45.923 169,470 49,271 218,741 101,056 499,283 600,339 819,080 Question 1 Total: 30 Marks (a) Discuss the concept of the Agency Problem. (3 Marks) (b) Is it ethical for tobacco companies to sell a product that is known to be addictive and a danger to the health of the user? Is it relevant that the product is legal? (3 Marks) (c) Using the financial statements provided, compute the following ratios for WITCO for 2020 and 2021. i. Debt to Equity (2 Marks) (2 Marks) ii. Total Debt Ratio iii. Times Interest Earned (3 Marks) iv. Cash Coverage (3 Marks) (10 Marks) v. Return on Equity - Using the Du Pont Identity (d) Using the results of your calculation in part c (i - iv) above, perform a trend analysis on WITCO's financial leverage ratios (discuss if these ratios improved or deteriorated between 2020 and 2021 and suggest possible reasons for increases/decreases where possible). Clearly indicate in your analysis what each ratio measures/suggests about the company. (4 Marks) 1

Step by Step Solution

There are 3 Steps involved in it

a Discuss the concept of the Agency Problem The Agency Problem arises when there is a conflict of interest between the management agents and the shareholders principals of a company Managers may pursu... View full answer

Get step-by-step solutions from verified subject matter experts