Question: Please answer in Excel Format Precision Systems Inc. does not have any debt and its cost of capital is 11.0 percent. Suppose that Precision Systems

Please answer in Excel Format

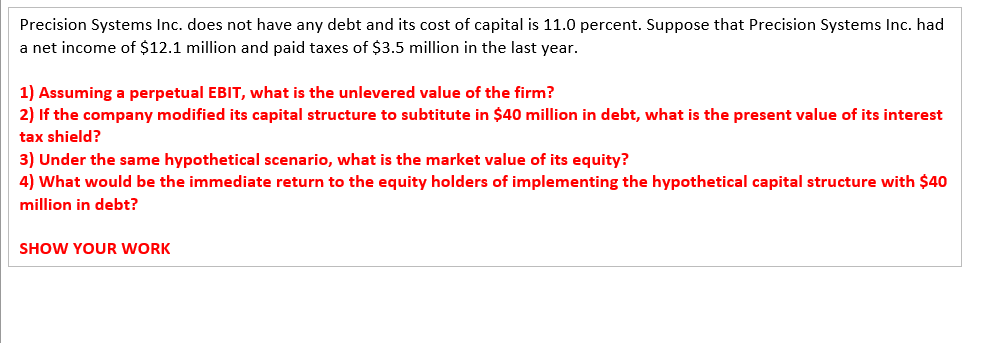

Precision Systems Inc. does not have any debt and its cost of capital is 11.0 percent. Suppose that Precision Systems Inc. had a net income of $12.1 million and paid taxes of $3.5 million in the last year. 1) Assuming a perpetual EBIT, what is the unlevered value of the firm? 2) If the company modified its capital structure to subtitute in $40 million in debt, what is the present value of its interest tax shield? 3) Under the same hypothetical scenario, what is the market value of its equity? 4) What would be the immediate return to the equity holders of implementing the hypothetical capital structure with $40 million in debt? SHOW YOUR WORK

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts