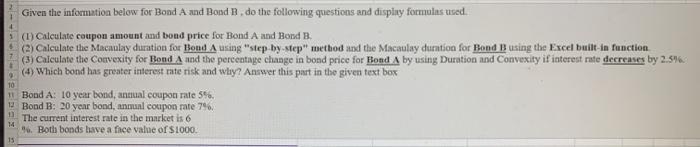

Question: please answer in excel with formula text 4 Given the information below for Bond A and Bond 8. do the following questions and displny formuinsused.

4 Given the information below for Bond A and Bond 8. do the following questions and displny formuinsused. (1) Calculate coupon amount and bond price for Bond A and Bond B. (2) Calculate the Macaulay duration for Bond A using "step by step" method and the Macaulay duration for Bond Busing the Excel built-in function (3) Calculate the Convexity for Bond A and the percentage change in bond price for Bond A by using Duration and Convexity if interest rate decreases by 2.5%. (4) Which bond has greater interest rate risk and why? Answer this part in the given text box 11 Bond A: 10 year bond, annual coupon rate 5%. 1 Bond B: 20 year bond, anmul coupon rate 7% The current interest rate in the market is 6 9. Both bonds have a face value of $1000, 10 15 4 Given the information below for Bond A and Bond 8. do the following questions and displny formuinsused. (1) Calculate coupon amount and bond price for Bond A and Bond B. (2) Calculate the Macaulay duration for Bond A using "step by step" method and the Macaulay duration for Bond Busing the Excel built-in function (3) Calculate the Convexity for Bond A and the percentage change in bond price for Bond A by using Duration and Convexity if interest rate decreases by 2.5%. (4) Which bond has greater interest rate risk and why? Answer this part in the given text box 11 Bond A: 10 year bond, annual coupon rate 5%. 1 Bond B: 20 year bond, anmul coupon rate 7% The current interest rate in the market is 6 9. Both bonds have a face value of $1000, 10 15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts