Question: please answer in the given format according to question Peari Limited purchased an asset at a cost of $45,000 on March 1, 2023. The asset

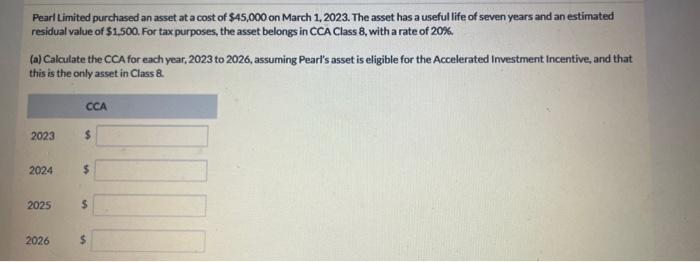

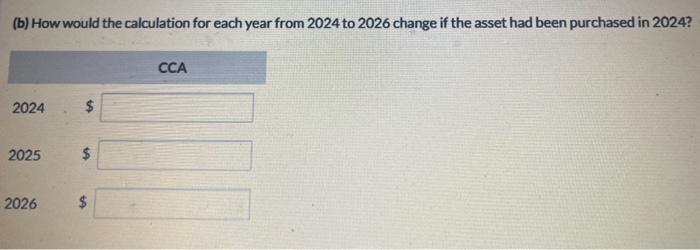

Peari Limited purchased an asset at a cost of $45,000 on March 1, 2023. The asset has a useful life of seven years and an estimated residual value of $1.500. For tax purposes, the asset belongs in CCA Class 8 , with a rate of 20%. (a) Calculate the CCA for each year, 2023 to 2026, assuming Pearl's asset is eligible for the Accelerated Investment Incentive, and tha this is the only asset in Class 8 . (b) How would the calculation for each year from 2024 to 2026 change if the asset had been purchased in 2024

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts