Question: Please answer in the same format as the question. It follows the Canadian tax act. This is one question!!! On January 1, 2020, Sandhill Ltd.

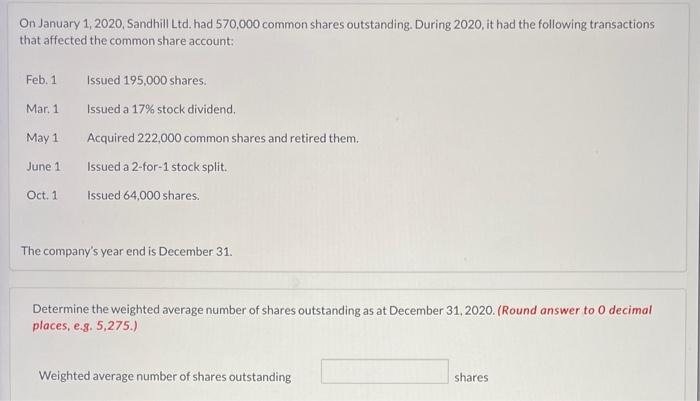

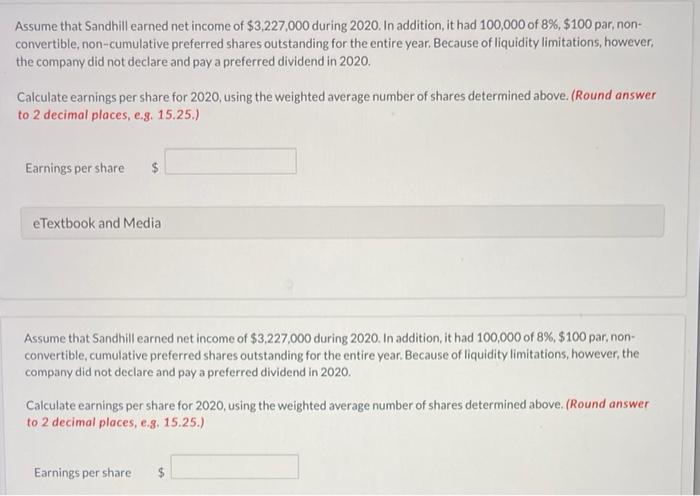

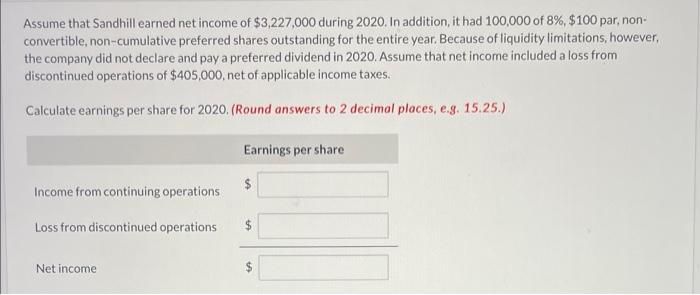

On January 1, 2020, Sandhill Ltd. had 570,000 common shares outstanding. During 2020 , it had the following transactions that affected the common share account: Feb.1 Issued 195,000 shares. Mar. 1 Issueda 17\% stock dividend, May 1 Acquired 222,000 common shares and retired them. June 1 Issued a 2-for-1 stock split. Oct.1 Issued 64,000 shares. The company's year end is December 31 . Determine the weighted average number of shares outstanding as at December 31,2020 . (Round answer to 0 decimal places, e.g. 5,275.) Weighted average number of shares outstanding shares Assume that Sandhill earned net income of $3,227,000 during 2020 . In addition, it had 100,000 of 8%,$100 par, nonconvertible, non-cumulative preferred shares outstanding for the entire year. Because of liquidity limitations, however. the company did not declare and pay a preferred dividend in 2020. Calculate earnings per share for 2020 , using the weighted average number of shares determined above. (Round answer to 2 decimal places, e.g. 15.25.) Earnings pershare $ eTextbook and Media Assume that Sandhill earned net income of $3,227,000 during 2020. In addition, it had 100,000 of 8%,$100 par, nonconvertible, cumulative preferred shares outstanding for the entire year. Because of liquidity limitations, however, the company did not declare and pay a preferred dividend in 2020. Calculate earnings per share for 2020, using the weighted average number of shares determined above. (Round answer to 2 decimal places, e.g. 15.25.) Earnings per share $ Assume that Sandhill earned net income of $3,227,000 during 2020 . In addition, it had 100,000 of 8%,$100 par, nonconvertible, non-cumulative preferred shares outstanding for the entire year. Because of liquidity limitations, however, the company did not declare and pay a preferred dividend in 2020. Assume that net income included a loss from discontinued operations of $405,000, net of applicable income taxes. Calculate earnings per share for 2020 , (Round answers to 2 decimal places, e.g. 15.25.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts