Question: Please answer in the same format as the question. This is one question and it follows the Canadian tax system. Thank you On January 1,

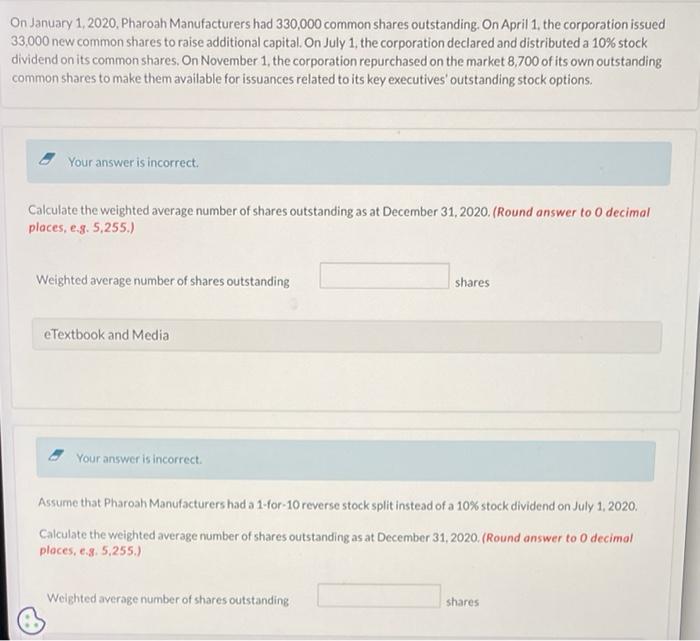

On January 1, 2020. Pharoah Manufacturers had 330,000 common shares outstanding. On April 1, the corporation issued 33,000 new common shares to raise additional capital. On July 1, the corporation declared and distributed a 10% stock dividend on its common shares. On November 1, the corporation repurchased on the market 8,700 of its own outstanding common shares to make them available for issuances related to its key executives' outstanding stock options. Your answer is incorrect. Calculate the weighted average number of shares outstanding as at December 31,2020 . (Round answer to 0 decimal places, e.g. 5,255.) Weighted average number of shares outstanding shares eTextbook and Media Your answer is incorrect. Assume that Pharoah Manufacturers had a 1-for-10 reverse stock split instead of a 10\% stock dividend on July 1,2020. Calculate the weighted average number of shares outstanding as at December 31,2020 . (Round answer to 0 decimal places, e.8. 5.255.) Weighted average number of shares outstanding shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts