Question: please answer incorrect ones A company based in the United Kingdom has an Italian subsidiary. The subsidiary generates 25,000,000 a year, received in equivalent semiannual

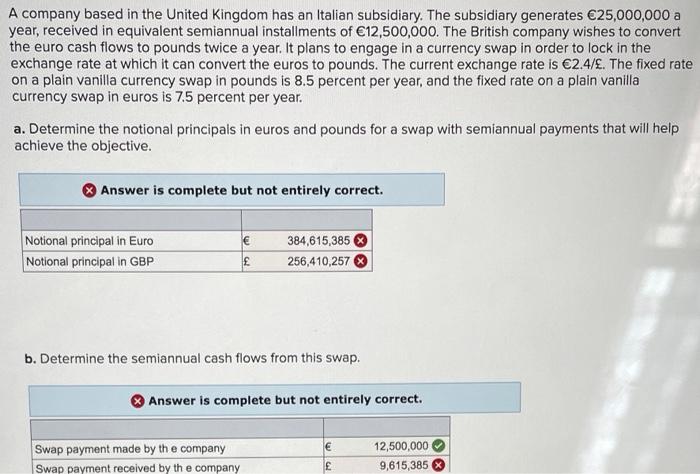

A company based in the United Kingdom has an Italian subsidiary. The subsidiary generates 25,000,000 a year, received in equivalent semiannual installments of 12,500,000. The British company wishes to convert the euro cash flows to pounds twice a year. It plans to engage in a currency swap in order to lock in the exchange rate at which it can convert the euros to pounds. The current exchange rate is 2.4/. The fixed rate on a plain vanilla currency swap in pounds is 8.5 percent per year, and the fixed rate on a plain vanilla currency swap in euros is 7.5 percent per year. a. Determine the notional principals in euros and pounds for a swap with semiannual payments that will help achieve the objective. Answer is complete but not entirely correct. Notional principal in Euro Notional principal in GBP 384,615,385 256,410,257 b. Determine the semiannual cash flows from this swap. Answer is complete but not entirely correct. Swap payment made by the company Swap payment received by the company 12,500,000 9,615,385 E

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts