Question: PLEASE ANSWER IT CORRECTLY THANK YOU! Table 14-1: Monthly Payments to Amortize Principal and Interest per $1,000 Financed 40 Interest Rate (%) 3.50 3.75 6.16

PLEASE ANSWER IT CORRECTLY THANK YOU!

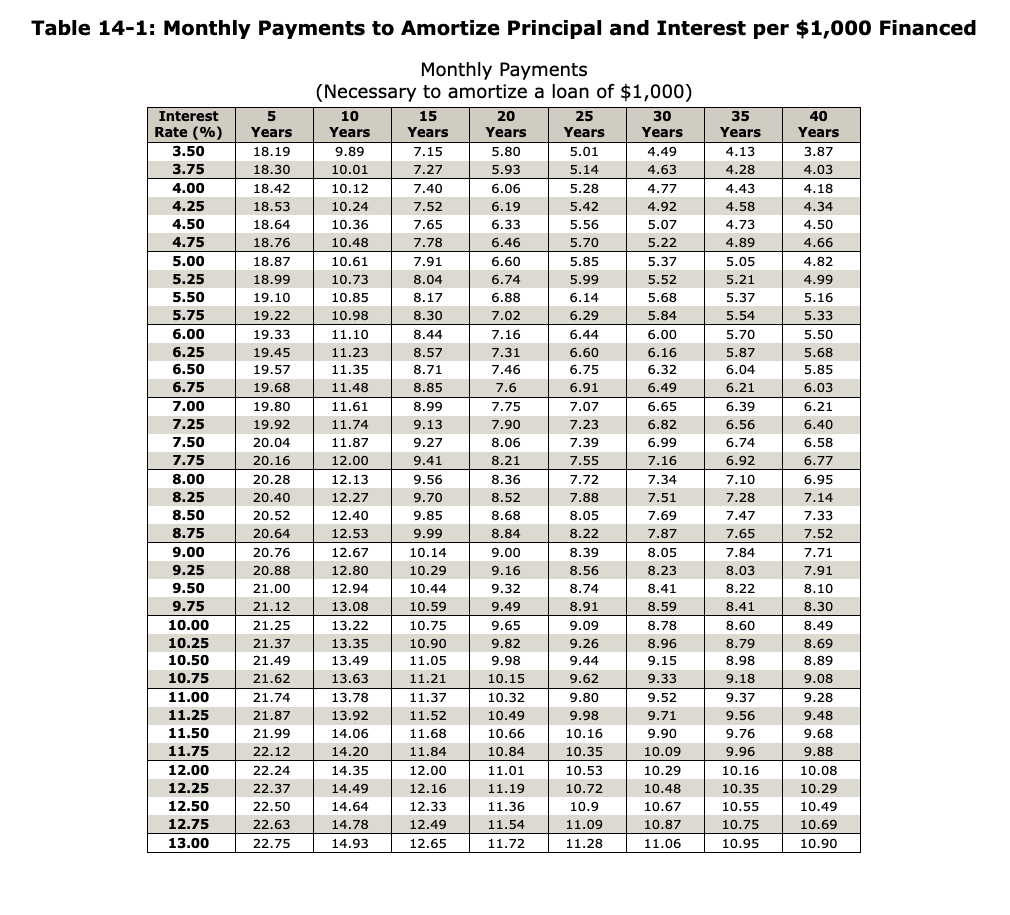

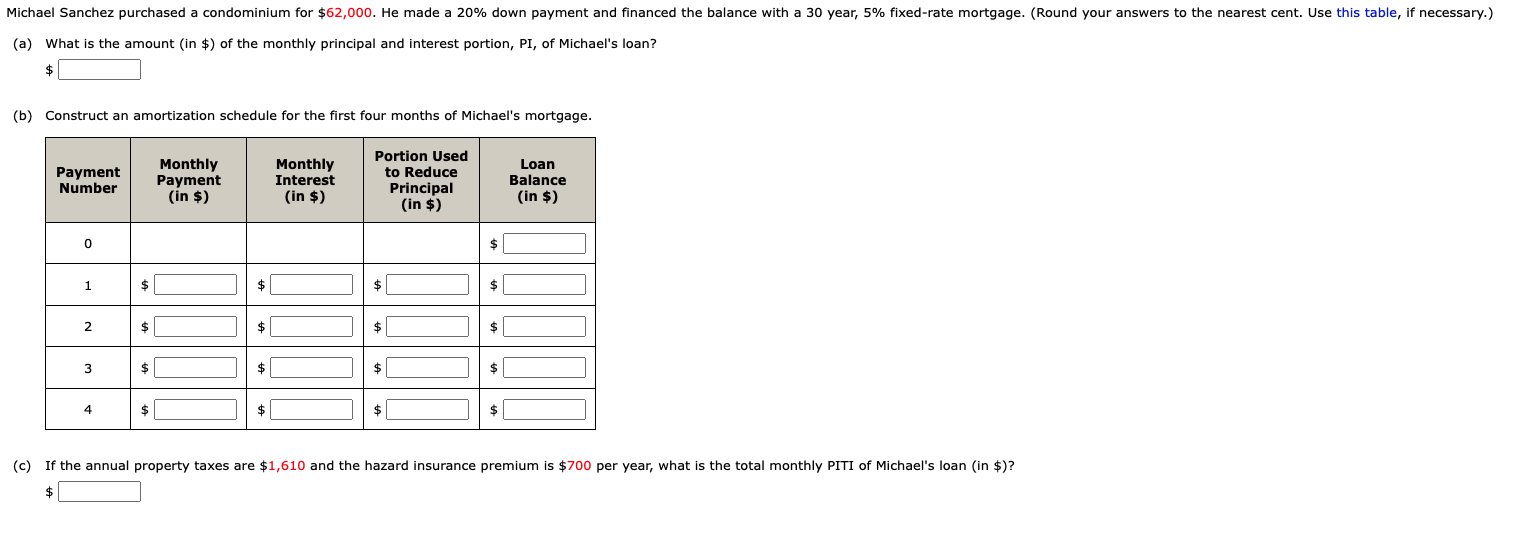

Table 14-1: Monthly Payments to Amortize Principal and Interest per $1,000 Financed 40 Interest Rate (%) 3.50 3.75 6.16 4.00 4.25 4.50 4.75 5.00 5.25 5.50 5.75 6.00 6.25 6.50 6.75 7.00 7.25 7.50 7.75 8.00 8.25 8.50 8.75 9.00 9.25 9.50 9.75 10.00 10.25 10.50 10.75 11.00 11.25 11.50 11.75 12.00 12.25 12.50 12.75 13.00 5 Years 18.19 18.30 18.42 18.53 18.64 18.76 18.87 18.99 19.10 19.22 19.33 19.45 19.57 19.68 19.80 19.92 20.04 20.16 20.28 20.40 20.52 20.64 20.76 20.88 21.00 21.12 21.25 21.37 21.49 21.62 Monthly Payments (Necessary to amortize a loan of $1,000) 10 15 20 25 30 Years Years Years Years Years 9.89 7.15 5.80 5.01 4.49 10.01 7.27 5.93 5.14 4.63 10.12 7.40 6.06 5.28 4.77 10.24 7.52 6.19 5.42 4.92 10.36 7.65 6.33 5.56 5.07 10.48 7.78 6.46 5.70 5.22 10.61 7.91 6.60 5.85 5.37 10.73 8.04 6.74 5.99 5.52 10.85 8.17 6.88 6.14 5.68 10.98 8.30 7.02 6.29 5.84 11.10 8.44 7.16 6.44 6.00 11.23 8.57 7.31 6.60 11.35 8.71 7.46 6.75 6.32 11.48 8.85 7.6 6.91 6.49 11.61 8.99 7.75 7.07 6.65 11.74 9.13 7.90 7.23 6.82 11.87 9.27 8.06 7.39 6.99 12.00 9.41 8.21 7.55 7.16 12.13 9.56 8.36 7.72 7.34 12.27 9.70 8.52 7.88 7.51 12.40 9.85 8.68 8.05 7.69 12.53 9.99 8.84 8.22 7.87 12.67 10.14 9.00 8.39 8.05 12.80 10.29 9.16 8.56 8.23 12.94 10.44 9.32 8.41 13.08 10.59 9.49 8.91 8.59 13.22 10.75 9.65 9.09 8.78 13.35 10.90 9.82 9.26 8.96 13.49 11.05 9.98 9.44 9.15 13.63 11.21 10.15 9.62 9.33 13.78 11.37 10.32 9.80 9.52 13.92 11.52 10.49 9.98 9.71 14.06 11.68 10.66 10.16 9.90 14.20 11.84 10.84 10.35 10.09 14.35 12.00 11.01 10.53 10.29 14.49 12.16 11.19 10.72 10.48 14.64 12.33 11.36 10.9 10.67 14.78 12.49 11.54 11.09 10.87 14.93 12.65 11.72 11.28 11.06 35 Years 4.13 4.28 4.43 4.58 4.73 4.89 5.05 5.21 5.37 5.54 5.70 5.87 6.04 6.21 6.39 6.56 6.74 6.92 7.10 7.28 7.47 7.65 7.84 8.03 8.22 8.41 8.60 8.79 8.98 9.18 9.37 9.56 9.76 9.96 10.16 10.35 10.55 10.75 10.95 Years 3.87 4.03 4.18 4.34 4.50 4.66 4.82 4.99 5.16 5.33 5.50 5.68 5.85 6.03 6.21 6.40 6.58 6.77 6.95 7.14 7.33 7.52 7.71 7.91 8.10 8.30 8.49 8.69 8.89 9.08 9.28 9.48 9.68 9.88 10.08 10.29 10.49 10.69 10.90 8.74 21.74 21.87 21.99 22.12 22.24 22.37 22.50 22.63 22.75 TTT 1 ! Michael Sanchez purchased a condominium for $62,000. He made a 20% down payment and financed the balance with a 30 year, 5% fixed-rate mortgage. (Round your answers to the nearest cent. Use this table, if necessary.) (a) What is the amount (in $) of the monthly principal and interest portion, PI, of Michael's loan? $ (b) Construct an amortization schedule for the first four months of Michael's mortgage. Payment Number Monthly Payment (in $) Monthly Interest (in $) Portion Used to Reduce Principal (in $) Loan Balance (in $) 0 $ 1 $ $ $ $ 2 $ $ $ $ 3 $ $ $ $ 4 $ $ $ (c) If the annual property taxes are $1,610 and the hazard insurance premium is $700 per year, what is the total monthly PITI of Michael's loan in $)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts