Question: please answer it step by step as i am weak in even basics of finance. its taken from capita budgeting and firms investment decisions. please

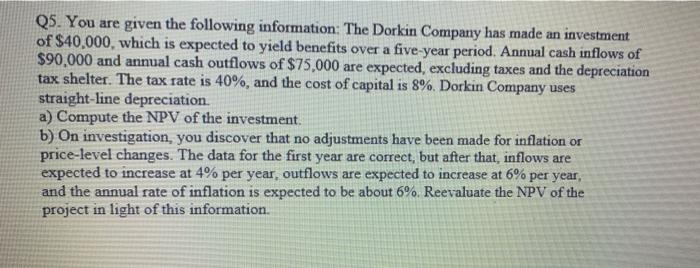

Q5. You are given the following information: The Dorkin Company has made an investment of $40,000, which is expected to yield benefits over a five-year period. Annual cash inflows of $90,000 and annual cash outflows of $75,000 are expected, excluding taxes and the depreciation tax shelter. The tax rate is 40%, and the cost of capital is 8%. Dorkin Company uses straight-line depreciation a) Compute the NPV of the investment. b) On investigation, you discover that no adjustments have been made for inflation or price-level changes. The data for the first year are correct, but after that, inflows are expected to increase at 4% per year, outflows are expected to increase at 6% per year, and the annual rate of inflation is expected to be about 6% Reevaluate the NPV of the project in light of this information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts