Question: Please create or give a step by step way to build a depreciation tax shield calculation model You have just started with UPS as a

Please create or give a step by step way to build a depreciation tax shield calculation model

Please create or give a step by step way to build a depreciation tax shield calculation model

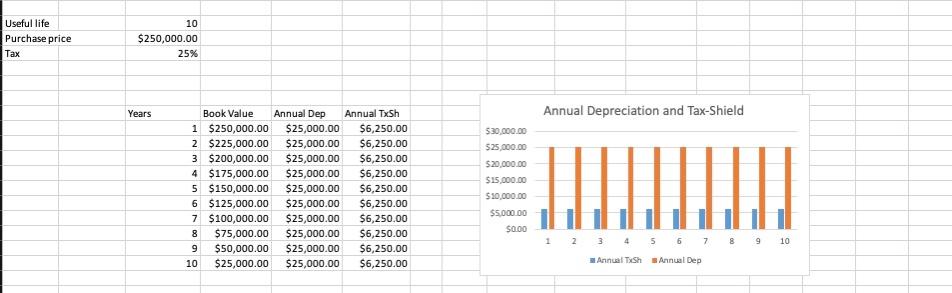

You have just started with UPS as a financial analyst and your manager asks that you build a "depreciation tax shield" calculation model. The main purpose of the model is to track the annual amount of tax that is saved thanks to depreciation. Your manager appreciates concise results, especially plotted on a chart. Useful life Purchase price Tax 10 $250,000.00 Years 25% Book Value Annual Dep Annual TxSh 1 $250,000.00 $25,000.00 $6,250.00 2 $225,000.00 $25,000.00 $6,250.00 3 $200,000.00 $25,000.00 $6,250.00 4 $175,000.00 $25,000.00 $6,250.00 5 $150,000.00 $25,000.00 $6,250.00 6 $125,000.00 $25,000.00 $6,250.00 7 $100,000.00 $25,000.00 $6,250.00 8 $75,000.00 $25,000.00 $6,250.00 9 $50,000.00 $25,000.00 $6,250.00 10 $25,000.00 $25,000.00 $6,250.00 $30,000.00 $25,000.00 $20,000.00 $15,000.00 $10,000.00 $5,000.00 $0.00 Annual Depreciation and Tax-Shield 1 2 3 4 Annual TxSh 5 6 7 8 9 10 Annual Dep

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts