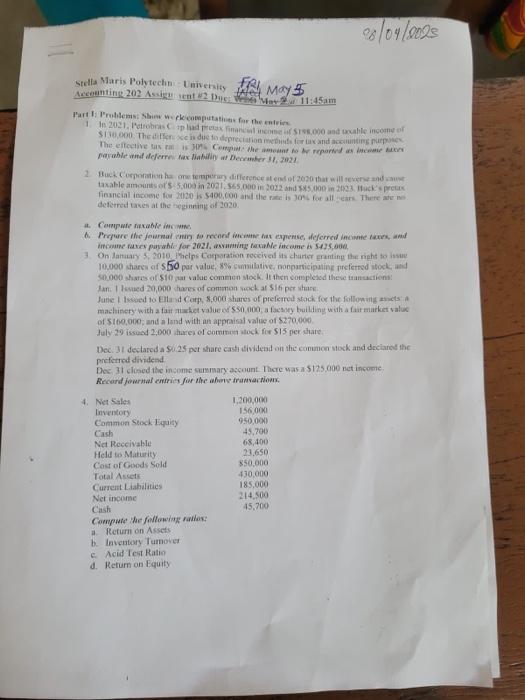

Question: Please answer it tasable amountsots 5,000 in 2021 . Sc.5,000 in 2022 and 585,000 in 2028 . Huck specas fiesncial incoene for 2020 is $400,600

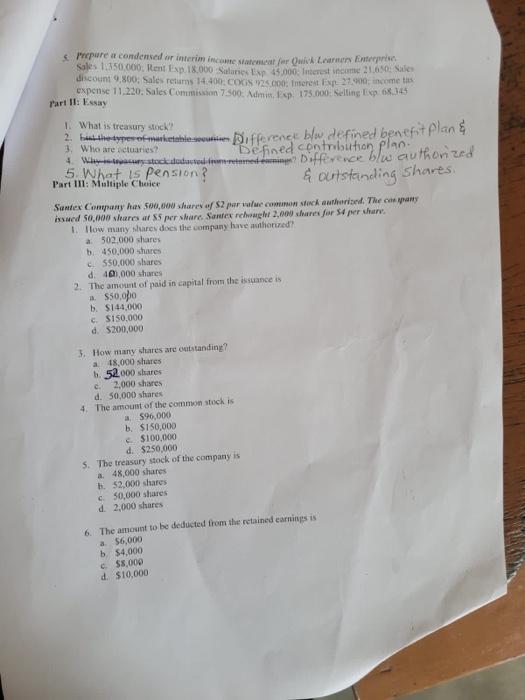

tasable amountsots 5,000 in 2021 . Sc.5,000 in 2022 and 585,000 in 2028 . Huck specas fiesncial incoene for 2020 is $400,600 and the fice is loxs foe all weare. There ate as defernet taven at the hegingang of 2020 . a. Cermpote nutable imsinne. 3. On Jattaay 5, 2018. Phelpi Cerpuration roceiset is charicr eranting the right to issue 10.000 sharch af 550 par value, 85 cumilative, nonparticipating prefermod atock, ind Han. I lased 20,000 theres of comman suck at Sit per share: Janc I tsoed to Elland Corp, $,000 shares of prefered sack for the folloneng anicts a of 5160,000 , and a land with an apperisal value of 8270,000 July-2.9 issued 2,000 hares of commen ilock for 515 per thate. Deci 31 destarcd a 50.25 pot share cast tividead on the eanmon siock and deciared the preferred dividend. Des, 31 cloned the income summary account. Thcre was a 5125,000 net incomic. Recard fournal emtrich for ite ahow iranvactions. 4. Prepiare a condensed or imterim incane satemeat fer Qwivk Learnten Emterpriae. Pari II: 1ssay 1. What is treasury stock? Diferenet bined contribution plan. 5. What is pension? Part III: Muatiple Cheiec E ourtstanding shares. Santex Conmanty thas 500,000 sharev of $2 par waluc comamon shach autherised, The cote egany isvued 50,000 shares at 55 per share Sanetex rehaghter 2,000 sharer for 54 per shure: 1. Ilow many slares does the comgany have authorzedt a. 502,000 shares b. 450,000 shares c. 550,000 shares d. 4el,000shares 2. The amount of paid in capital from ihe isstance is a. 550,0 po b. 5144,000 c. 5150,000 d. 5200,000 3. How many shares sre cutstanding? a. 48,000 shares 6. 52000 stares c. 2,000 thares d. 50,000 shares 4. The amoust of the common stock is a. 596,000 b. $156,000 c. 5100,000 d. $250,000 5. The treasary stock of the company is a. 48,000 shares b. 52,0000 shares c. 50,000 shares d. 2,000 shares 6. The amount to be deducted from the retained earmiops is a. 56,000 b. 54,000 b. 58,000 d. $10,000 tasable amountsots 5,000 in 2021 . Sc.5,000 in 2022 and 585,000 in 2028 . Huck specas fiesncial incoene for 2020 is $400,600 and the fice is loxs foe all weare. There ate as defernet taven at the hegingang of 2020 . a. Cermpote nutable imsinne. 3. On Jattaay 5, 2018. Phelpi Cerpuration roceiset is charicr eranting the right to issue 10.000 sharch af 550 par value, 85 cumilative, nonparticipating prefermod atock, ind Han. I lased 20,000 theres of comman suck at Sit per share: Janc I tsoed to Elland Corp, $,000 shares of prefered sack for the folloneng anicts a of 5160,000 , and a land with an apperisal value of 8270,000 July-2.9 issued 2,000 hares of commen ilock for 515 per thate. Deci 31 destarcd a 50.25 pot share cast tividead on the eanmon siock and deciared the preferred dividend. Des, 31 cloned the income summary account. Thcre was a 5125,000 net incomic. Recard fournal emtrich for ite ahow iranvactions. 4. Prepiare a condensed or imterim incane satemeat fer Qwivk Learnten Emterpriae. Pari II: 1ssay 1. What is treasury stock? Diferenet bined contribution plan. 5. What is pension? Part III: Muatiple Cheiec E ourtstanding shares. Santex Conmanty thas 500,000 sharev of $2 par waluc comamon shach autherised, The cote egany isvued 50,000 shares at 55 per share Sanetex rehaghter 2,000 sharer for 54 per shure: 1. Ilow many slares does the comgany have authorzedt a. 502,000 shares b. 450,000 shares c. 550,000 shares d. 4el,000shares 2. The amount of paid in capital from ihe isstance is a. 550,0 po b. 5144,000 c. 5150,000 d. 5200,000 3. How many shares sre cutstanding? a. 48,000 shares 6. 52000 stares c. 2,000 thares d. 50,000 shares 4. The amoust of the common stock is a. 596,000 b. $156,000 c. 5100,000 d. $250,000 5. The treasary stock of the company is a. 48,000 shares b. 52,0000 shares c. 50,000 shares d. 2,000 shares 6. The amount to be deducted from the retained earmiops is a. 56,000 b. 54,000 b. 58,000 d. $10,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts