Question: PLEASE ANSWER IVE ASKED THIS 2 TIMES NOW! Popular Office Products (POP) produces and sols small storage and organizational products for office use. During the

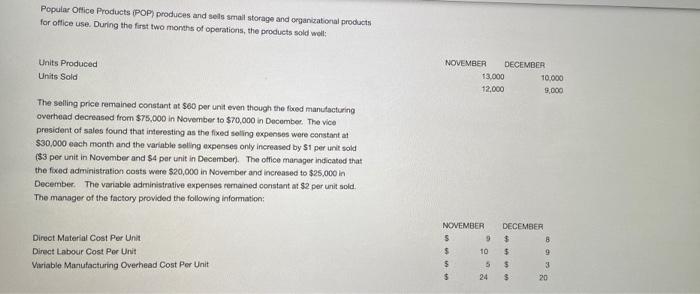

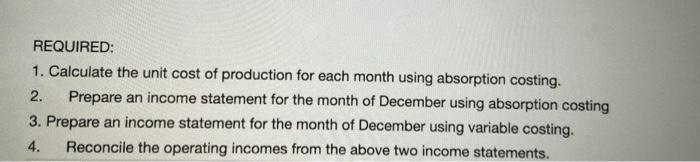

Popular Office Products (POP) produces and sols small storage and organizational products for office use. During the first two months of operations, the products sold wo NOVEMBER DECEMBER Units Produced Units Sold 13.000 10.000 12.000 9,000 The selling price remained constant at $60 per unit even though the food manufacturing overhead decreased from $75,000 in November to $70,000 in December. The vice president of sales found that interesting as the fixed selling expenses were constant at $30,000 each month and the variable soling expenses only increased by $1 per unit sold ($3 per unit in November and S4 per unit in December). The office manager indicated that the fixed administration costs were $20,000 in November and increased to $25.000 in December. The variable administrative expenses remained constant at $2 per unit sold The manager of the factory provided the following information: NOVEMBER DECEMBER Direct Material Cost Per Unit 5 $ B Direct Labour Cost Per Unit $ 10 $ 9 Variable Manufacturing Overhead Cost Per Unit 5 5 $ 3 $ 24 $ 20 REQUIRED: 1. Calculate the unit cost of production for each month using absorption costing. 2. Prepare an income statement for the month of December using absorption costing 3. Prepare an income statement for the month of December using variable costing. 4. Reconcile the operating incomes from the above two income statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts