Question: please answer just numbers 3 & 4 please Fast A manager decides to purchase 250,000 shares of a stock RLK at $50.00. By the time

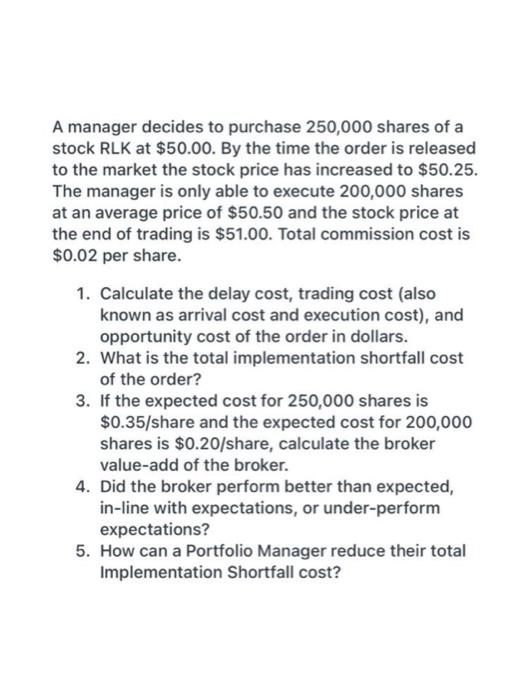

A manager decides to purchase 250,000 shares of a stock RLK at $50.00. By the time the order is released to the market the stock price has increased to $50.25. The manager is only able to execute 200,000 shares at an average price of $50.50 and the stock price at the end of trading is $51.00. Total commission cost is $0.02 per share. 1. Calculate the delay cost, trading cost (also known as arrival cost and execution cost), and opportunity cost of the order in dollars. 2. What is the total implementation shortfall cost of the order? 3. If the expected cost for 250,000 shares is $0.35/share and the expected cost for 200,000 shares is $0.20/share, calculate the broker value-add of the broker. 4. Did the broker perform better than expected, in-line with expectations, or under-perform expectations? 5. How can a Portfolio Manager reduce their total Implementation Shortfall cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts