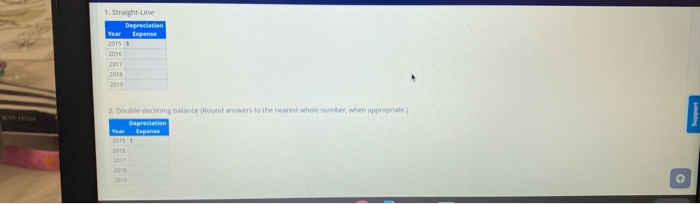

Question: please answer letter (. b) assume that the machine was purchased on July 1, 2015 ) and each year's answers for each year thank you

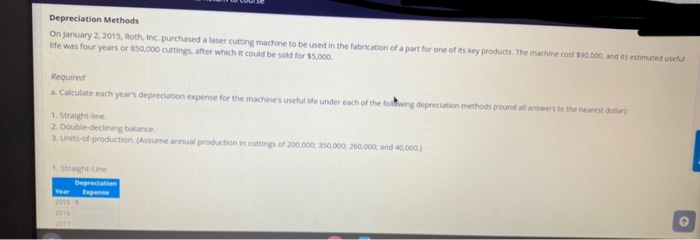

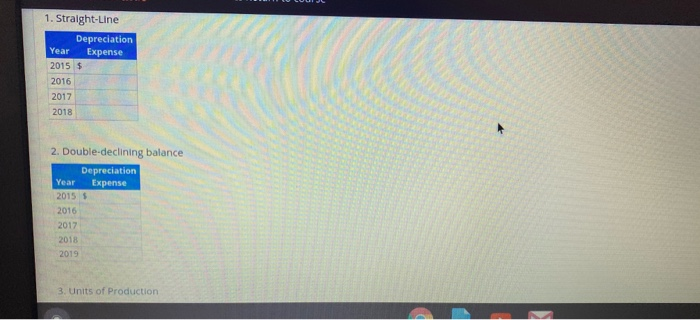

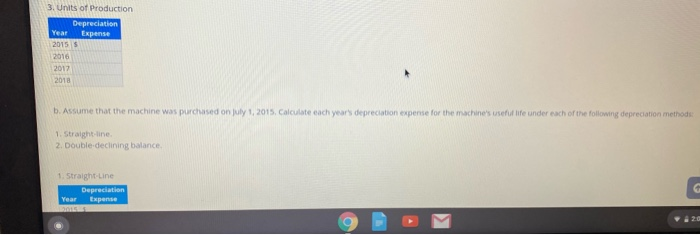

Depreciation Methods On January 2, 2015. Roth Inc. purchased a ser cutting machine to be used in the fabrication of a part for one of its key products. The machine cost $30.000, and its estimated useful He was four years or 850,000 cuttings, after which it could be sold for 55.000 Required Calculate each year's depreciation expense for the machines seue under each of the towing depreciation methods fround a nswers to the nearest dollar 1. Straight-line 2. Double-declining balance 3. Urts of production (Assume annual production in cutting of 200000 350.000 200.000 and 40.000) 1rtune Depreciation - 1. Straight-Line Depreciation Year Expense 2015 $ 2016 2017 2018 2. Double-declining balance Depreciation Year Expense 2015 $ 2016 2017 2018 2019 3. Units of Production 3. Units of production Year Depreciation Expense 2013 b. Assume that the machine was purchased on July 1, 2015. Calculate each year's depreciation expense for the machine's rond life under each of the following depreciation methods 2. Double declining balance. 1 Strant une Year Depreciation Expense 1. Straight-une 2. Double declining balance un when appropriate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts