Question: please do not cut off answers . please show how to solve and answers for wrong problems. Depreciation Methods On January 2, 2015, Roth, Inc.

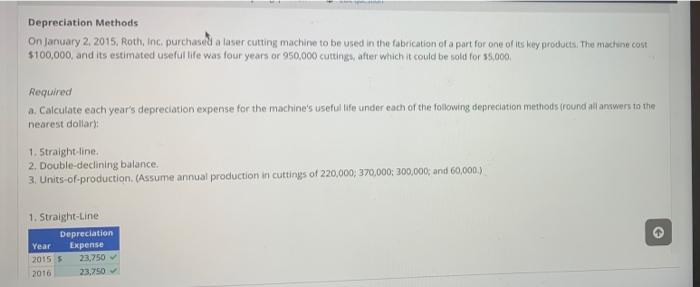

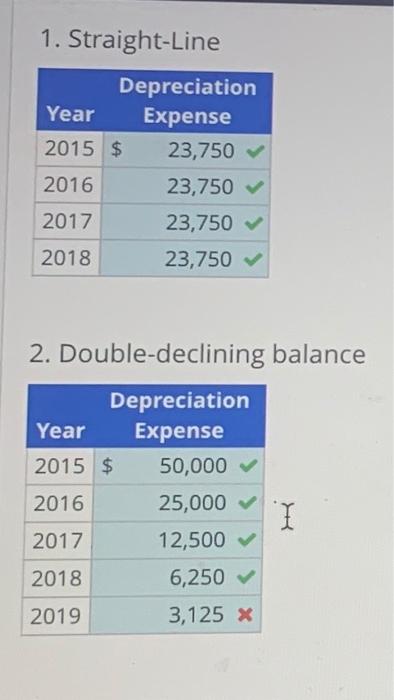

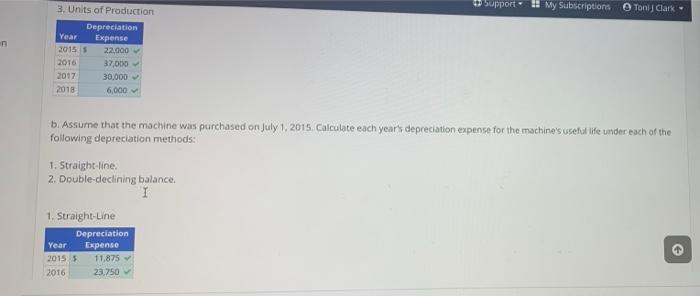

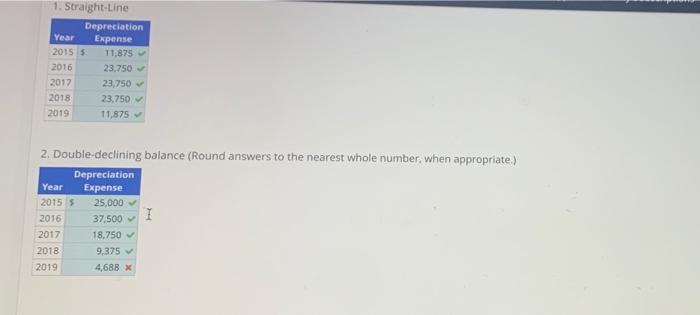

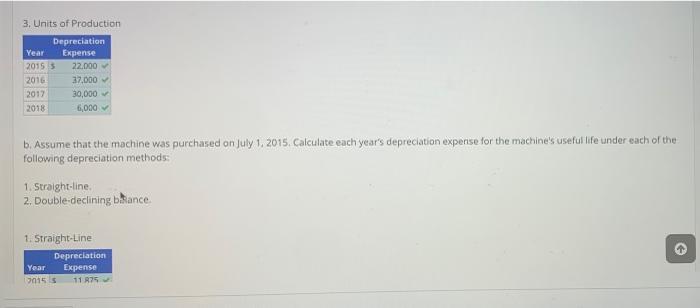

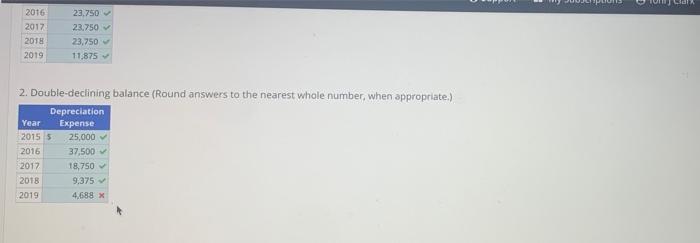

Depreciation Methods On January 2, 2015, Roth, Inc. purchase a laser cutting machine to be used in the fabrication of a part for one of its way prochucts. The machine cout $100,000, and its estimated useful life was four years or 950,000) cuttings, after which it could be told for 55.000 Required a. Calculate each year's depreciation expense for the machine's useful life under each of the following depreciation methods (round all answers to the nearest dollar 1. Straight line 2. Double-declining balance. 3. Units-of-production (Assume annual production in cuttings of 220,000, 370,000; 300,000; and 60,000) 1. Straight-Line Depreciation Year Expense 2015 5 23,750 2016 23,750 Support - My Subscriptions Toni Clark - n 3. Units of Production Depreciation Year Expense 2015 22.000 2016 37,000 2017 30.000 2018 6,000 b. Assume that the machine was purchased on July 1, 2015. Calculate each year's depreciation expense for the machine's useful life under each of the following depreciation methods: 1. Straight line 2. Double-declining balance 1 1. Straight-Line Depreciation Expense 2015 5 11.875 2016 23.750 Year 1. Straight-Line Depreciation Year Expense 2015 5 11.875 2016 23.750 2017 23,750 2018 23,750 2019 11.875 2. Double-declining balance (Round answers to the nearest whole number, when appropriate.) Depreciation Year Expense 2015 5 25,000 2016 37.500 I 2017 18.750 2018 9,375 2019 4,688 X 3. Units of Production Depreciation Year Expense 2015 5 22.000 2016 37,000 2017 30,000 2018 6,000 b. Assume that the machine was purchased on July 1, 2016. Calculate each year's depreciation expense for the machine's useful life under each of the following depreciation methods: 1. Straight-line 2. Double-declining bance 1. Straight-Line Depreciation Year Expense 00155 11 R75 WO 2016 2017 2018 2019 23.750 23.750 23,750 11.875 2. Double-declining balance (Round answers to the nearest whole number, when appropriate.) Depreciation Year Expense 2015 5 25,000 2016 37,500 2017 18,750 2018 9,375 2019 4.688 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts